The manufacturing PMI was little changed in November, staying marginally above the neutral threshold at 50.1. Both output and new orders indices were up marginally on the month, while the employment gauge declined at the same space as in the prior month. The survey's forward-looking components remained strong, with the backlog of work index rising and the orders-to-inventory ratio at 1.19, near its long-term average.

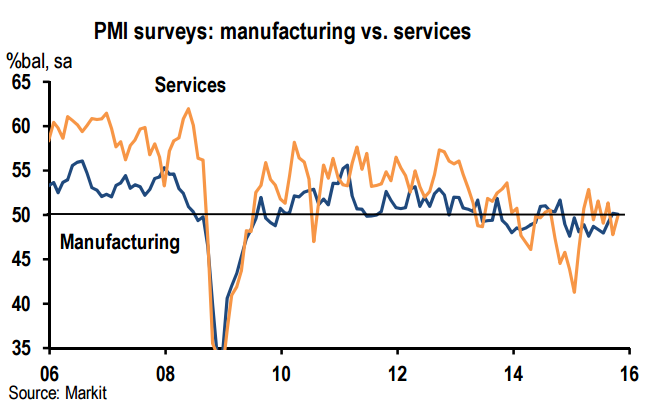

Rosstat's business survey showed a marginal rise in manufacturing business confidence in November and a further solid rise in mining confidence. The business activity index in the services PMI jumped to 49.8 from 47.8, recouping most of the prior months' losses. The employment index also rose in November. However, the forward-looking new orders and future business expectations measures both declined. The divergence between the tradable and non-tradable (services) sectors of the economy is expected to persist as the economy adjusts to a lower real effective exchange rate.

Russia's business surveys firmed in November

Tuesday, December 22, 2015 9:25 PM UTC

Editor's Picks

- Market Data

Most Popular

7

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX