Introducing the rouble's free float has mitigated the impact of the oil price shock on the Russian economy much better than in the 2008-09 crisis. The economy contracted 3.4% y/y in H1 15, better than the market expected.

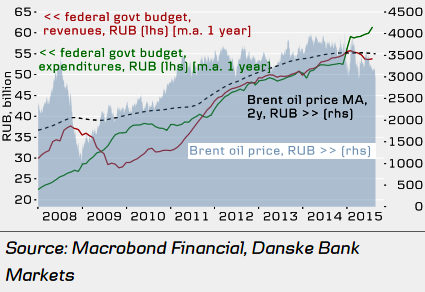

However, given the continual fall in the oil price, the rouble is currently still overvalued, which is weighing on fiscal stability. The oil price has fallen dramatically in rouble terms this year, jeopardising budget execution, as the gap between boosting expenditure and shrinking revenues is widening.

"The bearish view remains on the rouble reiterating the current forecasts for the USD/RUB, 70.00 at 3 months, 72.00 at 6 months and 70.00 at 12 months. EUR/RUB is forecasted at 77.00 (3 months), 79.20 (6 months) and 80.50 (12 months)", says Danske Bank.

Russia’s budget at risk on overvalued rouble

Thursday, August 27, 2015 4:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022