The dip in Russia's fixed investments and industrial production was less (-5.6% y/y and -3.7% y/y, respectively) than expected while the demand side continues to disappoint on the back of the purchase power crash.

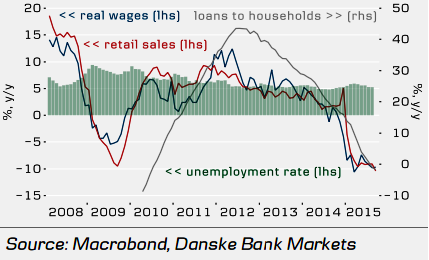

As inflation remained high, real wages growth (-9.7% y/y) shrank the most in 16 years, pushing retail sales to their lowest level since 1998 (-10.4% y/y).

"The real wages are expected to shrink further in 2016 as the future budget will see imminent cuts on the expenditure side. The unemployment rate fell to 5.2% in September from 5.3% a month earlier, continuing to support demand", says Danske Bank.

Russian consumers have suffered the most during the current recession. Purchase power fell to its weakest in years as 2015 average inflation is at 15.5% y/y, pushed up by the devalued rouble and limited supply due to Russia's counter measures.

Russian consumer turmoil continues

Wednesday, October 21, 2015 5:30 AM UTC

Editor's Picks

- Market Data

Most Popular

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions