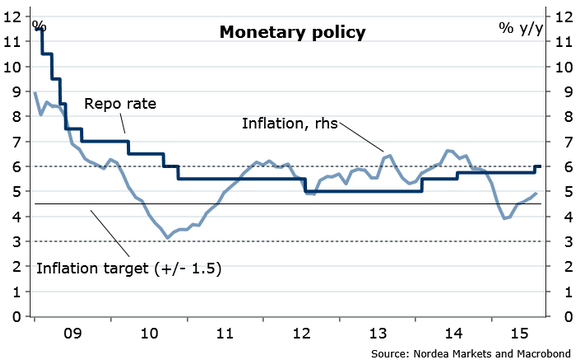

The surprising contraction of the activity in Q2 has made the probabilities of a September hike of 25 bp start to fade away, and it looks more possible the SARB will stay on hold at the next meeting. However, the SARB has continued to express the need for rate normalisation over time and concerns ahead of the approaching Fed hike.

At the last meeting in July when it raised the policy rate by 25 bp it expressed concerns over the deterioration of the medium-term inflation outlook, with inflation expected to breach the upper end of the target in H2 2016, foresees Nordea Bank. The ZAR weakness was expressed as one of the major concerns, implying a risk of second-round effects on inflation expectations.

"Therefore we keep our call of one more hike of 25 bp this year and for the SARB to continue to hike rates to 7.00% in 2016", says Nordea Bank.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed