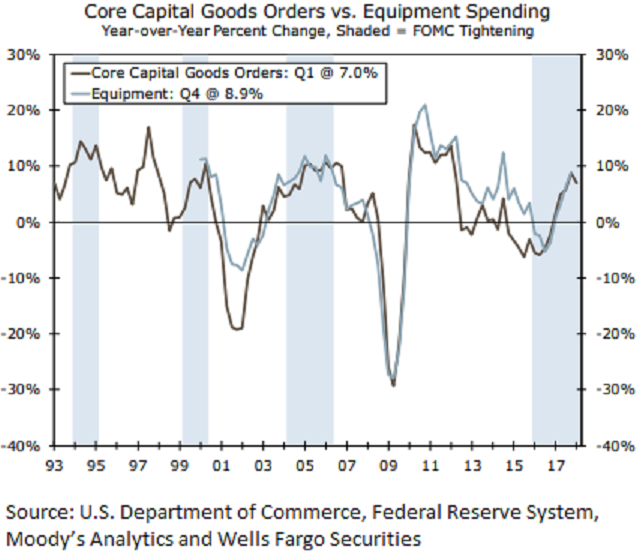

The recent rise in borrowing costs in the United States pose serious headwinds to capital investments and is likely to weigh on equipment spending as well, a recent research report by Wells Fargo Securities found.

After rising at a double-digit pace in the second half of 2017, equipment spending looks to have cooled in the first quarter of this year. The slowdown may lead to some concerns that higher interest rates are beginning to take a bite out of what was an impressive run for equipment spending last year.

On the contrary, the Federal Reserve’s tightening stance has hardly been a death knell for business spending. Equipment spending has actually strengthened since the Fed began raising rates in late 2015 and, in previous cycles, remained buoyant as interest rates rose.

Financial conditions also remain supportive of business spending. The Fed’s Senior Loan Officer Opinion Survey shows banks on net easing business lending standards over the past year, while the Chicago Fed’s National Financial Conditions Index indicates conditions are easier today than when the Fed began normalization in 2015.

Meanwhile, higher interest rates will hurt at the margin, and the initial rebound in commodity-related investment following the partial recovery in prices is beginning to fade. At the same time, capital spending plans have wobbled in April as the initial euphoria regarding the tax plan has faded and trade-war concerns have grown.

"We anticipate the tailwinds to win out over the headwinds, but for equipment spending to moderate to around a six percent pace later this year," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves