Riksbank (Sweden's central bank) meets on July 4th to decide monetary policy and we believe there is unlikely to be any change in either interest rates or forward guidance. The Riksbank is likely to look through strong Swedish economy. The tone of the statement is likely to be more relaxed as inflation has been higher than expected.

Data released earlier today showed that Sweden's foreign trade balance turned to a surplus in May from a deficit in the previous year, as exports grew faster than imports. The trade surplus came in at SEK 2.8 billion in May versus a deficit of SEK 3.6 billion in the corresponding month last year. In April, the trade balance showed a shortfall of SEK 3.2 billion. The value of exports surged 18.0 percent year-over-year in May and imports climbed by 11.0 percent.

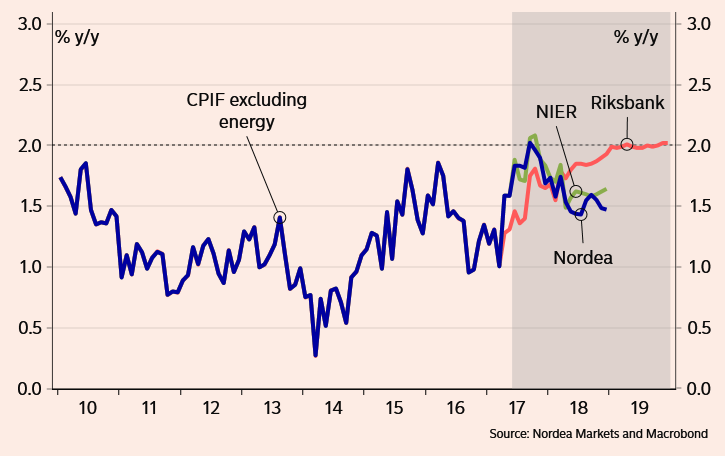

The lower-than-expected Q1 GDP growth may not be a concern as resource utilisation is still at a high level, which is a condition for increasing inflation according to the Riksbank. Sweden's CPIF gauge of inflation came in at 1.9 percent year-on-year in May, as compared with the Riksbank’s projection of 1.7 percent and consensus expectations of 1.8 percent. The central bank has been struggling to keep inflation around its 2 percent target level in recent months, encouraging it to reiterate its commitment to negative interest rates and quantitative easing.

A turnaround in the central bank’s monetary policy stance is still a long way off as currency moves can have a big impact on inflation in the trade-dependent Swedish economy. The Riksbank fears that tightening before the ECB would lead to a strong appreciation of the krona, hurting exports while making imports cheaper and dragging inflation down. Moreover, the ECB has also signalled that it is less likely to step on the accelerator again.

"We expect the Riksbank to stay sidelined at the meeting in July. The monetary policy tool box will be left untouched and it seems unlikely that the interest rate path will be altered. We see the first rate hike in the autumn 2018 and a negative repo rate of -0.25% by December 2018," said Nordea Bank in a report.

EUR/SEK remains largely range bound between 9.80 and 0.97 since the beginning of the month. The pair has largely been on a rising trend since Feb 2017. Technical studies point to further upside. Immediate support is seen at 50-DMA at 9.70, while 9.8239 (61.8% Fib retrace of 10.0804 to 9.40900) is immediate resistance.

FxWirePro's Hourly EUR Spot Index was at 145.538 (Bullish) at 1220 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom