Do you expect any further slumps in kiwi dollar?

RSI (14) signaling falling price convergence and it would continue to be in downtrend for some more time. While long bearish real body resembling dark cloud candle has formed. At present the pair is testing trend line support at 0.6815 levels.

We recommend buying NZD/USD put back-spread so as to extract leverage and participate in prevailing downtrend & fetch highest profitability.

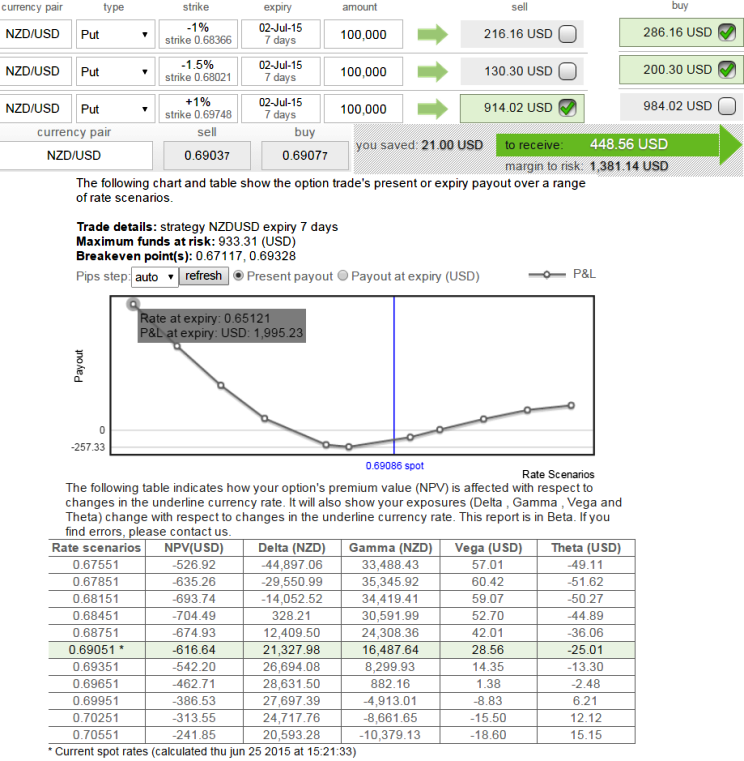

Sell NZD/USD 7D (+1%) In-the-Money put option and simultaneously buy 7D (-1%) Out-Of-The-Money delta put option and 7D (-1.5%) Deep Out-Of-The-Money put option.

It is an unlimited profit on downside, limited risk to the extent of net units on short sides.

This strategy is advised when the options trader reckons that the underlying exchange rate will experience significant downside movement in the near term.

The individual instruments and combined position should have option geeks as shown below.

(-1%) OTM put - delta -0.29, vega 33.49

(-1.5%) Deep OTM put - delta -0.20, vega 27.73

Combined - delta 0.21, vega 28.56

If this strategy should yield better returns then the exchange rate should not fall in the range between 0.6708 - 0.6930.

Reverse Put Ratio Spread for NZD/USD hedging

Thursday, June 25, 2015 10:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?