We at FxWirePro asked ourselves - "what could be China's real problem or management challenge?"

Several answers came to mind

- Shifting the economy away from investment and export oriented growth to consumption oriented?

- Slowdown in economy amid reduction in domestic demand (mostly industrial) as well as foreign demand?

- Capital outflow?

- Indebtedness?

While all of them are contributing to dull future (we are not overly pessimistic on capabilities of world's second largest economy), indebtedness just stands out.

The problem

Corporate and domestic indebtedness remains biggest management challenge for Chinese authorities. China thanks to decade of dominance in exports has accumulated world's largest reserve, as of last month, $3.525 trillion. Over the past years reserve has fallen from record $3.99 trillion in June, 2014.

This drop is concerning, as it came on the back of very high current account surplus (last few months' on an average $60 billion) and positive FDI flow (declining though). Which brings us to our concern number three (capital outflow). Capital outflow pace has been close to $800 billion/annum.

China has used its reserve direct or indirectly, to pop up its falling stock market, to stabilize Yuan amid capital outflow or to recapitalize banks. Recent rise of FX reserve, we expect has been over cheered. PBoC and other banks' purchase of foreign exchange (which can be seen as proxy for capital flow) has just been 2 billion Yuan in October, compared to 761 billion sell in September.

So from where this outflow is coming - it is difficult to exactly pin it, however out best guess is mixture - some portfolio investments flying out (foreign funds have been net sellers of Chinese equities and bonds), however that though is above $60 billion but not large enough compared to sheer size of outflow. Domestic outflow to foreign assets could be another major contributor (rise of real estate prices in Oceania), which could be large but still fails to explain the sheer size.

So our best guess to this point, is reversal of decade long Yuan carry trade, years long metal financing trade and corporate debt repayment. Though corporate de-leveraging is good, Chinese FX reserve might just not be enough to cover for that.

Level of indebtedness

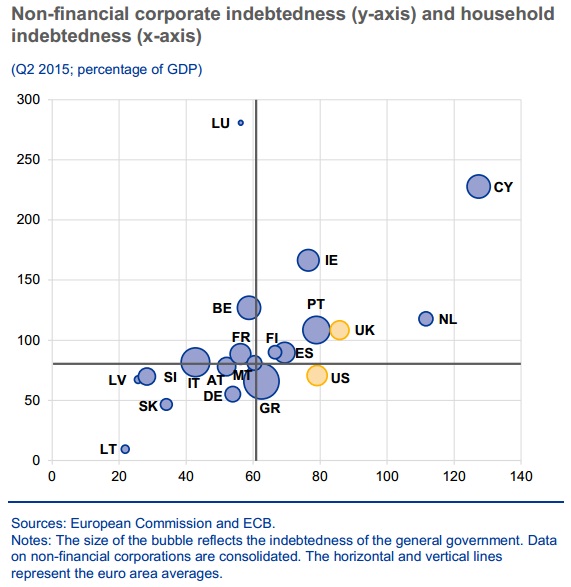

According to latest calculation (reference chart, European Central Bank's financial stability review November, 2015). While Government's debt to GDP ratio is small, close to 41% as of 2014, corporate indebtedness is above 200% and more than 120% for households.

Even taking a conservative estimate, total liability could be around $20-22 trillion Dollar, which clearly dwarf the FX reserve, even considering only one fourth denominated in foreign currency and short term (less than three years). According to Morgan Stanly estimate, China's FX debt is around $3.3 trillion, however real challenge is almost 50% of that is held by 5% of corporates.

With slower growth in the economy, companies and the municipalities won't be able to return the rate of issuance (which is steeply higher, since PBoC reduces rates 5 times already I last 12 months). Expect lot of restructuring in China (both in domestic and foreign currency liabilities).

The real problem (really)

China's FX debt is definitely an issue, however it is much overhyped. Though some calculation difference exist but it can be concluded that China's net FX debt liability is not more than 20% of GDP (ohhh..thats nothing). Problem with FX debt is its concentration to few corporates, short term nature of it, rising Dollar interest rates.

Real problem is China's domestic debt, which is growing to touch 250% of GDP soon and if not checked, restructured or managed well...we are looking into a nationwide banking crisis ahead.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed