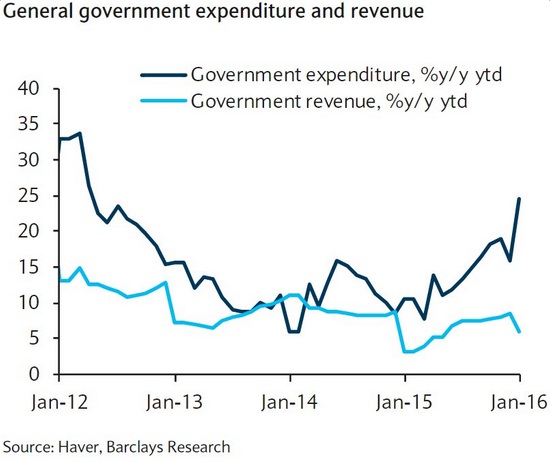

Latest data from Haver analytics and Barclays as shown in the graph, China is fiscally stimulating its economy, just like the officials suggested that they would let the fiscal deficit rise temporarily to stimulate the economy.

Increase in government expenditure in China after reaching as much as 35% y/y in early January has been dropping steadily and bottomed around 5% back in 2014. But since last year it has started growing steadily and in 2016 it has jumped sharply and now gaining at a pace close to 25% y/y.

Chinese policymakers announced their plans after budget meeting this month but it seems stimulus was on its way for quite a long before that. Chinese officials came to the conclusion that monetary stimulus won’t be enough to tackle slowdown in China.

While some has appreciated Beijing’s move others remain critical.

Pro-stimulus group argues, with low government debt and high current account balance China has room to maneuver on the fiscal side. So temporary increase in stimulus will actually be good in the longer run, stabilizing economy.

Exit group argues that this stimulus would feed into zombie firms, which otherwise would go bust, may inject more leverage to the housing sector, provide lesser incentives for local government to reduce debt burdens. They argue this additional expenditure would go to ease the pain of higher layoffs at state firms by providing attractive compensatory package to prevent social disruption.

The way we see it, if China wants to improve its ailing economy, pursue reforms and maintain social peace it has little choice but to increase debt temporarily. But if this additional spending, without reforms such as bring down the leverage across regional government and corporates than it would increase the risks in the economy by transferring it from corporate and municipal balance sheet to federal.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock