Volatility in the Chinese bond markets has become a contentious issue for the policymakers, who are struggling to contain the rise in yield amid an interest rate hike from the US Federal Reserve that has sparked renewed dollar rally.

In a previous article, we showed, how the recent strength of the dollar and the fear surrounding Chinese corporate debt have distorted the shift in the yield curve, where the shorter end of the curve jumped more than the longer end, and the very longer end jumped more than the 10-year. We suspect that the market is pricing a greater turmoil in the short and the very same reason is causing the volatility too.

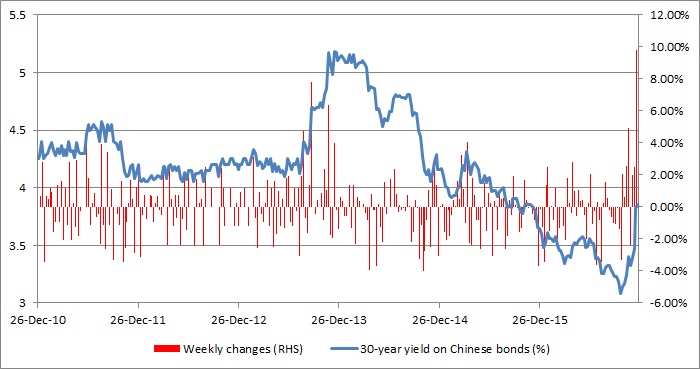

This chart shows the 30-year yield on Chinese government bond, along with the weekly changes. Last week, Chinese 30-year yield rose by 9.74 percent. We expect the People’s Bank of China (PBoC) to continue with its market operations to both contain volatility and yields.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January