Recent consumption data still looks favorable for the Indonesian inflation outlook ahead. The recent uptick in crude oil price is worth monitoring, especially given the plan for an upward revision in domestic electricity prices.

Headline inflation accelerated to 3.6 percent y/y in November, up from 3.3 percent in the previous month. The upward trend in headline inflation is likely to persist into 2017, with current projection penciling in average inflation at 4.5 percent next year, DBS reported.

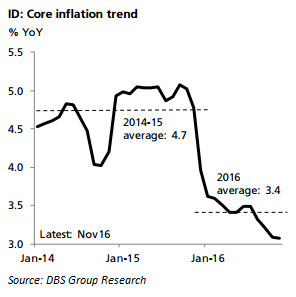

More interestingly, core inflation remains stuck at a multi-year low of 3.1 percent y/y in November. At a time when core inflation seems to be ticking up in the region, it has continued to fall in Indonesia. Oil price distortion has been dominant since late last year and it has clearly affected expectations significantly, pulling core inflation down.

"We reckon that inflationary expectation has been the main factor contributing to softer core inflation," the report said.

Meanwhile, if, instead, the fall in core inflation is purely an indication of slower underlying demand, then it is clearly a worrying trend.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target