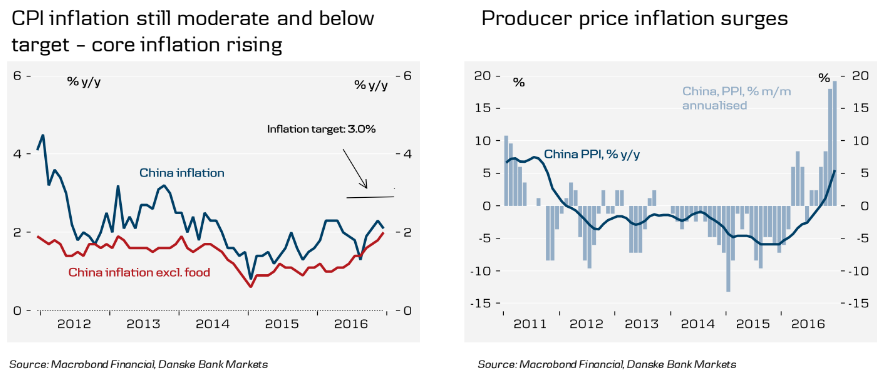

China Statistics Bureau report on January 10th showed China’s headline CPI inflation came in at 2.1 percent y/y in December, missing market expectations of 2.3 percent and below 2.3 percent recorded in November. On a monthly basis, CPI inflation rose 0.2 percent, up from 0.1 percent in the previous month.

However, China's producer prices rose for the fourth consecutive month in December to hit a 5-year high. China's producer prices rose in December at their fastest pace since September 2011 on strong raw material prices, signalling stabilization in the world's second largest economy. The producer price index gained 5.5 percent y/y compared with a 3.3 percent increase in November. The index increased 1.6 percent m/m in December, compared to 1.5 percent in November.

Rise in PPI inflation was fully in line with rise in commodity prices. Sharp rise in metal prices were observed over the past year, which accelerated post-Trump. Analysts expect PPI inflation to moderate again in 2017 as metal prices likely flatten out. That said, rise in PPI inflation is very supportive for profits. Higher producer prices improve profitability and thereby alleviate some of the liquidity pressure of corporates. That said, PPI inflation should moderate again in 2017 if metal prices flatten out.

Data suggests that "deflation is over", a trend analysts say could lead to less aggressive monetary policy. China normally hikes when CPI inflation rises which is not the case currently. Policy rates are likely to stay unchanged in the next 12-month horizon. The People's Bank of China (PBOC) is likely to hold a neutral position in its monetary policy as it pushes for structural reforms, such as tackling leverage in the property sector.

"The bottom line is that as long as the Chinese government is able to prevent deflation, (they can) buy time in order to fix some of the structural problems such as overcapacity, the economic outlook of China is not entirely pessimistic," said ANZ's chief economist for Greater China, Raymond Yeung.

Meanwhile, Shanghai Composite (SSEC) fell 0.30 percent to 3,161.67 and Shenzhen Composite (SZSE) Index slipped 0.25 percent to 10,306.34 by 07:15 GMT. FxWirePro's Hourly Yuan Strength Index remained neutral at 16.14 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election