The Reserve Bank of New Zealand (RBNZ) is scheduled to hold monetary policy meeting this Thursday when it releases its Monetary Policy Statement. A great deal has changed since the RBNZ’s November Statement. The RBNZ cut the cash rate in November to a new record low of 1.75 percent and said that the policy settings including the reduction of rate would see growth robust enough to have inflation come to the middle of the target range.

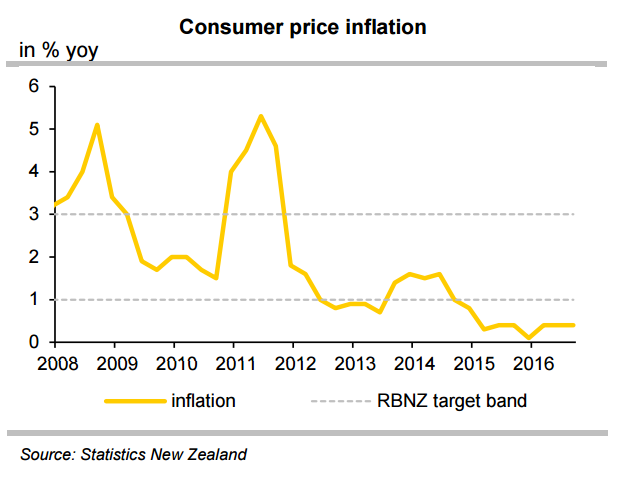

Recent data has shown that New Zealand headline inflation has risen back above 1 percent in December. Headline inflation returned to the RBNZ’s target band for the first time in two years, and some measures of core inflation are back at (or close) to 2 percent. The RBNZ inflation expectations survey, released earlier today, surprised markets with a healthy jump from 1.68 percent to 1.92 percent.

The risk of expectations falling further was highlighted as a key concern in the RBNZ’s last policy statement and today's increase will have been a welcome development by the RBNZ. Increases in population and the economy’s productive capacity are allowing GDP to grow at a solid pace without a significant lift in domestic-led cost pressures. We expect these factors could impart a slightly hawkish tone to Thursday’s press release.

Speculative positioning in NZD/USD, according to CFTC futures positions of leveraged and non-commercial trader types, indicates longs are starting to be rebuilt and are at the highest level since November. A full hike is now priced in by markets by November, and certainly an OCR at record lows (and projected by the RBNZ to remain that way for the foreseeable future in November) has become harder to justify.

"We expect the RBNZ to maintain the OCR at 1.75% next Thursday, which is a view shared by the consensus and market, and strike a balanced tone. In terms of the Bank’s forecasts, we are also not expecting a major change in message." said ANZ Research in a report.

NZD/USD was trading at 0.7290 at around 1135 GMT, down 0.49 percent on the day. Price action has slipped below 5-DMA and we expect some consolidation at current levels. Major support on the downside is seen at 0.7221 (20-day MA). The longer-term trend is higher, but some near-term weakness likely on a break below 200-day MA at 0.7112.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell