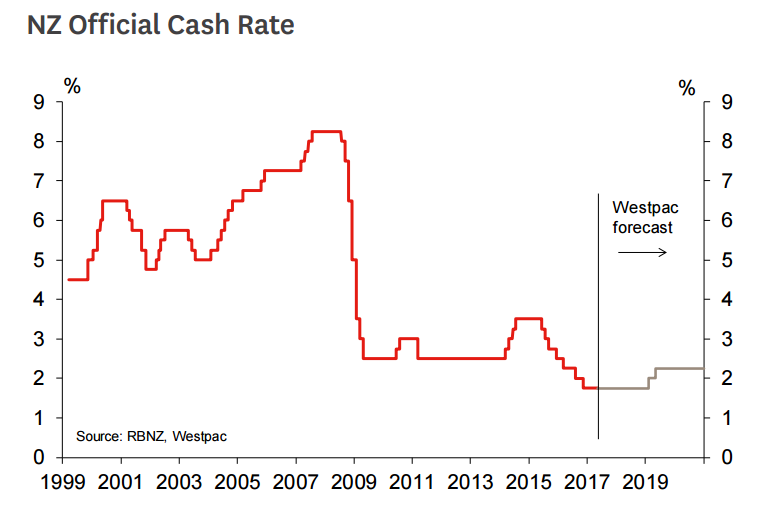

The Reserve Bank of New Zealand convenes to decide monetary policy on June 22 and we expect the central bank to stay pat at 1.75 pct. The statement is likely to reaffirm a neutral bias. At an interview following the May policy meeting, RBNZ chief economist emphasised that “there is an even chance of a hike or a cut in the future”. "There is a risk that next week’s statement could emphasise the equal likelihood of rate cuts or hikes. That could rattle financial markets, which are largely focusing on rate hike scenarios" said Westpac in a report.

Despite the progress in growth and inflation, the RBNZ stood by its firmly neutral stance in May in contrast to expectations of most economists who had expected the central bank to bring forward its projected timing for interest rate hikes, even if they remained somewhat distant. Economic developments in New Zealand since May have been mixed, but more or less balanced in terms of their consequences for monetary policy.

New Zealand GDP surprised to the downside during the first quarter of the year. Frist quarter GDP grew by 0.5 percent on a quarterly basis, falling short of expectations for 0.7 percent growth but slightly above the respective growth rate during the fourth quarter of 2016, which stood at 0.4 percent. On an annual basis, the economy grew by 2.5 percent, below expectations and the previous quarter’s 2.7 percent.

RBNZ has expressed concern about an under-shoot in construction activity, which would imply slower inflation. This week’s GDP figures for the March quarter will only amplify the RBNZ’s concerns. Much of the shortfall in Q1 GDP was due to a drop in construction. Analysts do not expect the slowdown in construction will sustain, nevertheless it adds the central bank's concerns. The housing market has continued to slow, though the RBNZ will probably still remain wary of a resurgence.

New Zealand's latest jobs data showed the unemployment rate fell to 4.9 percent in Q1 from 5.2 percent in the previous quarter but wage inflation remained muted. The RBNZ regarded the recent jump in inflation as temporary, and noted that the softer than expected starting point for the economy would mean a more gradual lift in domestic inflation pressures. Recent developments will only bolster those views.

"The OCR will remain on hold over 2017 and 2018. While we have pencilled in hikes for early 2019, we’d describe this more generally as being too far away to be precise about the timing," said Michael Gordon, Acting Chief Economist at Westpac.

NZD/USD was rejected at channel top at 0.7275, drag till 20-DMA at 0.7132 likely. The pair is consolidating weak New Zealand GDP led slump, is trading slightly higher on the day. An up-tick in Business NZ Manufacturing Index likely prompted some short-covering move. 20-DMA is still biased higher, we see major reversal only on break below 20-DMA currently at 0.7132.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand