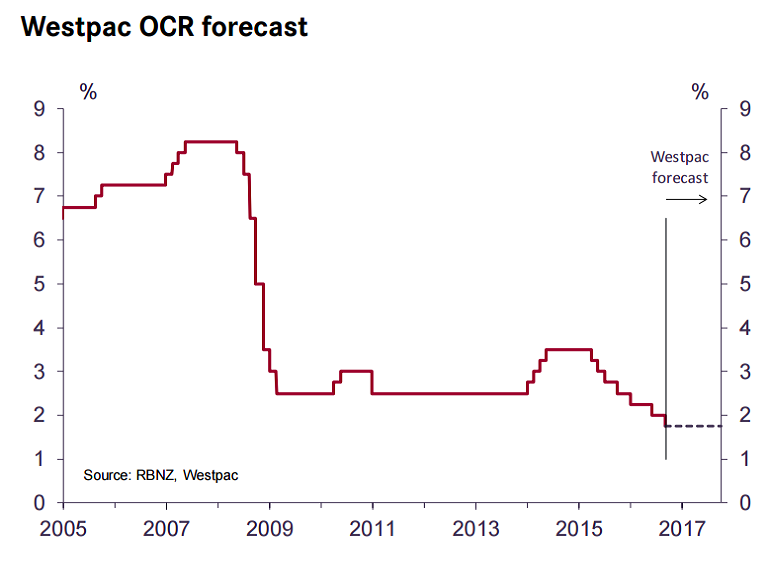

The Reserve Bank of New Zealand at Thursday's Monetary Policy meeting cut the Official Cash Rate to a new record low of 1.75 percent as widely expected and signalled it has probably done enough to return inflation to target as economic growth quickens. Downside risks to the domestic economic outlook have been dissipating and the RBNZ remains conscious of the risks of over-stimulating the economy and housing market, as well as the associated risks for the exchange rate.

The central bank shifted to a more neutral stance amid signs that the New Zealand economy is on increasingly solid footing, with positive signs in the household and business sectors, continued strong population growth, and gains in commodity prices. The Kiwi saw a knee-jerk spike to 0.73 levels initially following the interest-rate cut, but quickly pared gains before falling back to be little changed.

RBNZ Governor Graeme Wheeler said that the central bank remains worried about market instability and U.S. political upheavals, adding that heightened global market volatility in the wake of Donald Trump’s unexpected U.S. election win could trigger further rate cuts.

New Zealand “is not an economy that is crying out for urgent stimulus to boost inflation,” said Nick Tuffley, chief economist at ASB Bank Ltd. in Auckland. “From here we continue to expect the RBNZ will remain on hold, which is the RBNZ’s current stance.”

On the technical charts, 'Bearish Bat' pattern formed on NZD/USD dailies. We see scope for downside in the pair. 5-DMA is biased lower, along with Stochs and RSI. Strong support is seen at 0.7214 (20-DMA). Violation there could see further downside. NZD/USD was trading at 0.7222 at around 12:45 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks