The RBI is expected to remain on hold at its bimonthly monetary policy meeting today. Although production data continue to remain weak and growth concerns persist, the RBI would be more worried about how to keep inflation under control.

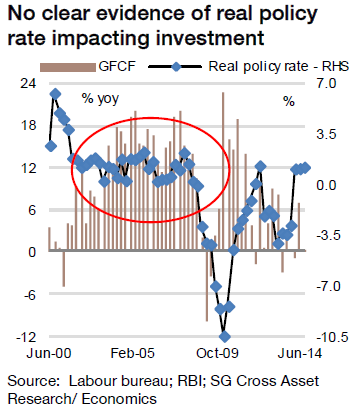

More importantly, there's no conclusive evidence that investment depends on lower rates to pick up. As the chart shows, India's investment rate averaged nearly 14% between 2002 and 2008 even though the real policy rate remained quite high.

According to Societe Generale, "As we have always maintained, it is the existing business climate rather than the lending rate that influences investment decisions. Therefore, the RBI would prefer to remain on hold during this meeting. However, we expect a dovish tone in its press release and retain scope for further rate cuts if inflation pans out as expect. As of now, we expect another cut (of 25bp) during the fourth quarter of 2015."

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX