India is in much better positioned than other emerging market counterparts. Indian Rupee along with other emerging market counterparts faced grave pressure during 2013, when then FED chairman Ben Bernanke provided first hint of tapering.

Some emerging currencies this year -

- Indonesian Rupiah is down 4.5% YTD against dollar.

- Turkish Lira is down 10.2% YTD against dollar.

- Brazilian Real is down 21.7% YTD against dollar.

- Thai Baht is up 1% YTD against dollar.

- Malaysian Ringgit is down 2.8% YTD against dollar.

- Mexican peso is down 1% YTD against dollar.

In contrast Indian Rupee has performed very well, Rupee is down 1.3% YTD against dollar and in last three months it even appreciated 1.85% against dollar.

- New reformist government at the center with stable majority continue to bolster confidence among investors over country's upcoming future.

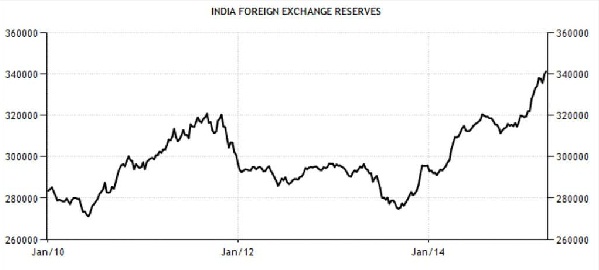

- India is seeing foreign inflows on a continuous basis, which could have made INR pretty strong. However Reserve Bank of India (RBI) is buying dollar on a continuous basis and enriching the country's coffer. Reserves have reached new heights at $341 billion as per latest report.

Buying by RBI, might keep the pressure on Rupee, however it makes the central bank better prepared to handle rate hike. Chart courtesy Trading economics.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand