The minutes of the monetary policy meeting of the Reserve Bank Board for November provided no significant surprises. The Aussie gained on Tuesday after minutes of the central bank's November board meeting noted some scope for further easing, though with overall conditions accommodative, AUDUSD traded at 0.7102, up 0.07%.

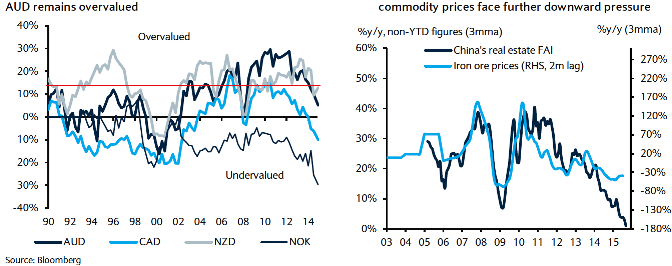

As anticipated RBA board meeting minutes have note provided any new information, as a result renewed weakness in global commodity prices should weigh on a still overvalued AUD this week.

Recent price declines should highlight Australia's large exposure to a slowing Chinese economy and the inability of its shrunken manufacturing export sector to compensate without further currency weakness (see FX Themes: AUD and NZD: Still expensive, 12 November 2015).

We carry technical stance as bearish AUDUSD against resistance near 0.7225 and looks for a move lower toward the 0.6935/0.6895 lows. A breach of the latter would signal further downside toward our greater targets near 0.6250.

Hence, shorting this overvalued currency cross (around 14%, see above charts) via near month futures would derive positive cash flows with leveraging effects targeting 0.6935 levels.

RBA provide interim relief to vulnerable AUD – no other strategy but shorting to rescue overvalued currency risk

Tuesday, November 17, 2015 1:32 PM UTC

Editor's Picks

- Market Data

Most Popular

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says