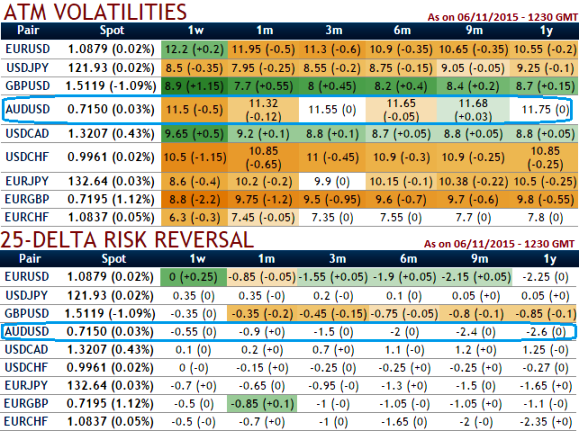

As you can observe from the diagram the implied volatility for near month at the money contracts of this APAC pair has been highest among G20 currency pool after EURUSD and is seen 11.5% for 1w expiry.

While delta risk reversal reveals downside hedging activity has been piling up. As a result we can understand ATM puts have been costlier where the FX market direction of this is heading towards 0.7007 technical levels.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for AUDUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Hence, AUDUSD's higher IV with negative delta risk reversal can be interpreted as the market reckons the price has downside potential for large movement which is resulting derivatives instruments for downside risks have been overpriced and fresh shorts are more on the cards.

As shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of ATM and OTM puts in the ratio of 2:1 so as to suit the swings on either directions.

As we expect upswings in short term, Capitalizing on higher IV we eye on shorting at the money puts with shorter expiries which would lock in certain yields by initial receipts of premiums.

Simultaneously, 2 lots of ITM -0.50 delta puts are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

FxWirePro: AUD/USD put writers on upper hand favoured by IV - use rallies to deploy shorts in PRBS

Monday, November 9, 2015 10:38 AM UTC

Editor's Picks

- Market Data

Most Popular