The Reserve Bank of Australia on Tuesday released minutes of the June board meeting when it held the cash rate at 1.75 percent. The minutes showed the RBA remains relatively upbeat about growth and employment at the same time alert to the risks of persistently low inflation. Markets were looking for clues in the minutes about whether or not the RBA has really taken on a holding pattern, but the minutes gave few hints regarding the future direction of policy.

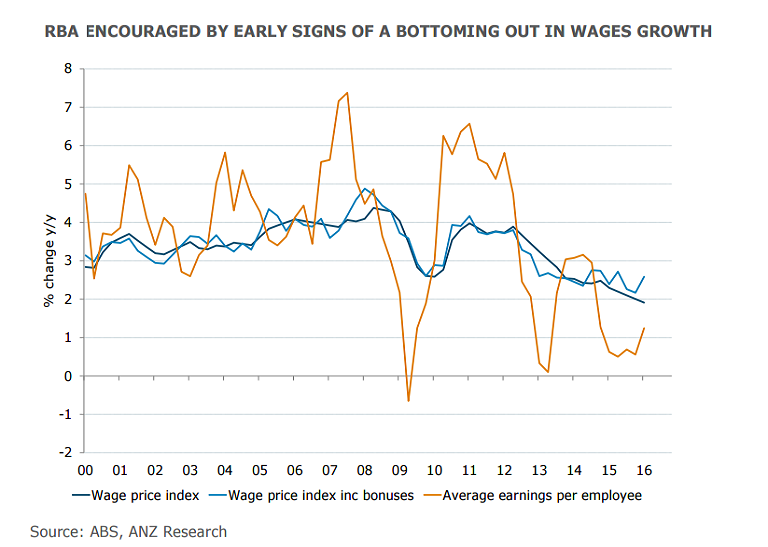

The RBA shifted its focus from inflation to the real side of the economy and seems to be in no rush to cut rates. The central bank played down the tick lower in the wage price index in Q1 and highlighting the stability in broader measures of the WPI, as well as the pick-up in the GDP measure of wages. With the unemployment rate holding steady at 5.7 percent, and first-quarter GDP growth coming in above expectations, the RBA appears content with the economic transition away from resource-related investment. The RBA has, however, noted the continued absence of broader inflationary pressures and added that inflation would be low for a long time.

"The key to future rate cuts lies in inflation. If inflation moves lower and stays lower for longer than the RBA is currently expecting then a further cut or cuts would make sense. We have a rate cut pencilled in for August as we believe the May rate cut alone will not achieve its aim of lifting inflation in the required time frame." notes Hans Kunnen, Chief Economist at St.George Bank.

Missing from the minutes were comments on the risks facing the global economy, apart from concerns over the ‘Brexit’ vote. There was nothing in these minutes on debt levels in China or the impact of the stronger USD on US export growth. However, the board did note that output in east Asia was growing at a below average pace.

Economists have not discounted a follow-up reduction in August, although current futures market pricing rates that only a 52 percent possibility. Overnight index swaps are still pricing in at least one 25bps reduction in RBA's main lending rate over the next year.

"Recent currency strength and the latest iteration of the Fed's re-think of how rate normalisation is likely to proceed will mean that the current pause is relatively short-lived, and that risks continue to remain biased towards a cash rate of 1 per cent in 2017," said JP Morgan economist Sally Auld.

Markets likely interpreted the document as broadly hawkish. Australian Dollar rallied against its major counterparts after June RBA minutes confirm a wait-and-see policy approach. Bond yield gains suggest ebbing rate cut expectations. The ASX 200 Index closed 0.43 pct higher at 5,279.30 points. AUD/USD extends upside above the 0.75 handle and was trading at 0.7499 at 0945 GMT.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist