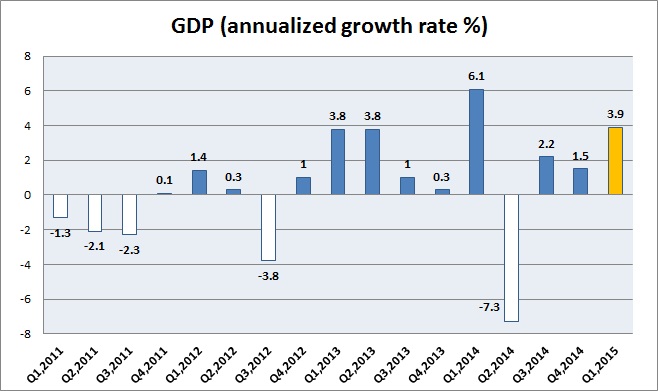

Bank of Japan (BOJ) can now feel proud and confident once more over its Qualitative and Quantitative Easing (QQE) program, after months of disappointment as first quarter GDP moved higher according to second flash estimate.

Key highlights -

- GDP rose by 1% q/q and 3.9% annualized rate. Growth rate is much higher than reading per first estimate, which forecasted GDP to rise 0.6% q/q and 2.4% annualized rate.

- Domestic demand rose by 1.1%, while private demand rose by 1.6%.

- Private residential investment and non-residential investments, both grew at solid pace, 1.7% and 2.7% respectively.

- Public sector remains a drag to GDP growth. Government consumption grew by meager 0.1%, while public investments shrank by 1.5%.

- Trades while growing, net balance remains a drag. Exports rose by 2.4%, while imports surpassed that by 2.9%.

The data is positive but not enough for Bank of Japan (BOJ) to reconsider its easing stance or scale back as inflation remains close to zero percent.

With bank of Japan, continuing its unprecedented easing there are little choice for Yen but to move down against dollar or consolidate with downside bias unless massive risk aversion unsettles market.

USD/JPY is currently trading at 125.5. Further upside is likely, as key level at 125 got broken over Non-farm last Friday.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand