June report shows that in spite of rise in inflation expectations, actual headline annual inflation remained weak at 0.2%, with countries like Greece, Slovenia, Cyprus, and Lithuania in deflationary territory.

European Central Bank's (ECB) mandate is price stability in Euro zone, which means keeping inflation below but close to zero percent.

- ECB's survey of professional forecaster (SPF) report shows inflation is expected to be just 1.3% in 2016, whereas it is likely to reach 1.9% by 2020.

If no change is made ECB's current asset purchase program will be ending in September, 2016.

However, ECB's asset purchase program is an open ended one which clearly says - "at least till September, 2016".

If SPF report holds true, then ECB will have ample wiggle room to expand the program. With a Nuclear deal reached between Iran and world powers, new supply is expected to hit the oil market in 2016, which in turn will keep the oil price low and depress inflation.

Why ECB might consider increasing QE?

- Lower inflation in Euro zone has made it possible for ECB to start asset purchase program in a bid to reflate the economy, however vision was much larger. It was also done to improve growth, employment make Euro are exports more competitive in world markets.

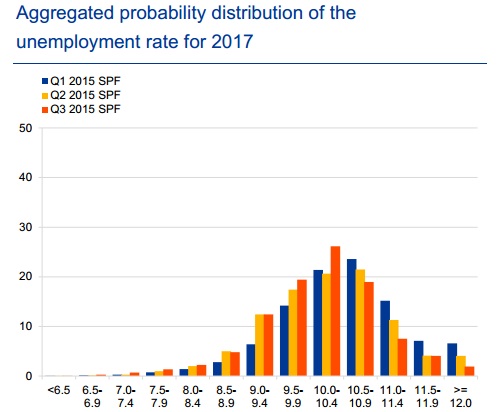

The above chart shows, unemployment is unlikely to decrease much by 2017. Probability distribution of the unemployment shows it is most likely to stay around 10%.

Europe is unlikely to reach full potential unless people have their jobs back.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate