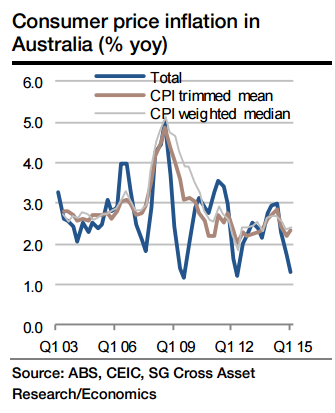

Overall price pressures in Australia are likely to have strengthened in Q2 compared to Q1, owing first and foremost to a big rebound in petrol prices. Whereas nationwide petrol prices plunged some 13% qoq in Q1, they rebounded 12% in Q2, which alone would add some 0.4pp to (quarterly) headline inflation. In this sense, the risks to the forecast of a 0.5% qoq gain after 0.2% in Q1 look skewed to the upside - although in seasonally-adjusted terms this would be equivalent to a 0.7% qoq gain after 0.3% in Q1.

However, the Australian dollar was under less downward pressure in Q2, declining by just 0.8% on a trade weighted basis, after drops of 5.2% qoq in Q1 and 4.3% in Q4 2014 - so imported price pressures should have been reduced. The only reason why the headline rate of inflation is likely to be stable is a sizeable base effect. Core inflation is likely to have been far more stable than at the headline level, with gains in line with the previous two quarters, i.e. consistent with around the middle of the 2-3% target range. But here too, upside risks arguably dominate, notwithstanding very low unit labour cost growth. One source of upward pressure is the development of (new) house prices, which appear understated in the CPI statistics relative to the residential house price data. All in all, the data are likely to indicate that the inflation tide is also turning in Australia. Over the coming quarters, headline and core inflation rates are expected to climb higher.

Price pressures in Australia rising – but base effect is containing headline rate

Monday, July 20, 2015 12:58 AM UTC

Editor's Picks

- Market Data

Most Popular

3