BoJ did not succumb to market pressure, instead decided not to provide additional stimulus to the struggling Japanese economy at Thursday's meet. The central bank's inaction sent shock waves across the markets. Nikkei Stock Average nosedived some 800 points and the Yen slumped over 200 pips as an immediate reaction. The BoJ pushed back the timing to achieve the 2% inflation target. It now expects to reach its target sometime during the fiscal year 2017.

"Even as markets brood over being snubbed by the BOJ, the broader perspective is that the BOJ simply deferred, rather than decided against, further stimulus," argued analysts at Mizuho.

Analysts argue that policy easings take time to have an impact, often months, and it was only reasonable for central banks to pause to weigh whether they were working. Many say the BOJ simply deferred, rather than decided against, further stimulus. BoJ wants to wait for the negative interest rate policy introduced only in January to exert its full impact. Financial institutions are still struggling to adapt to the new negative interest rate policy. In fact, financial institutions have not fully used the upper bound balance to which positive interest rates and zero interest rates are applied as compared to the BoJ’s estimate.

"In order to reduce the burden on financial institutions from the negative interest rate policy, arbitrage transactions among financial institutions need to be more active. If the BoJ is to implement additional QQE, the Bank needs to make sure such transactions become more active." said Societe Generale in a report.

It was important for the BoJ to live up to the financial market’s expectations if it did not want the JPY to appreciate. That said, even if the BoJ had implemented additional QQE, yen depreciation and a stock market rally could be limited or temporary which could lead to a larger risk of the markets losing confidence in the BoJ. Market may then once again perceive limits to the effectiveness of monetary policy.

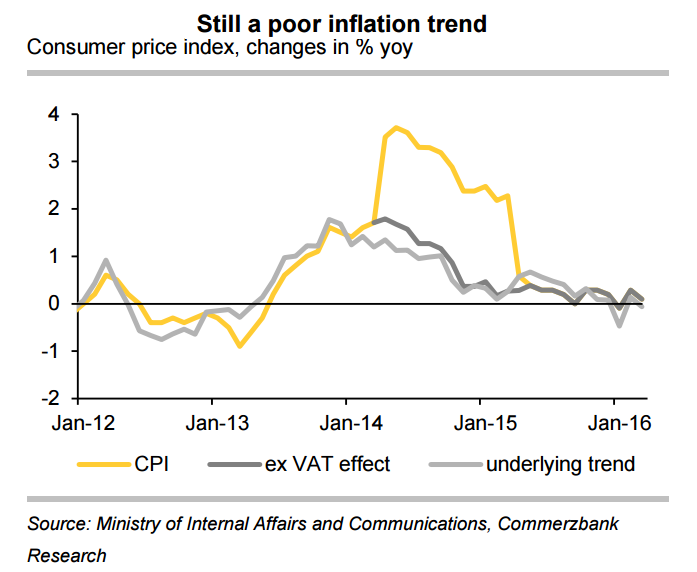

At current levels the exchange rate may not throw the Japanese economy permanently back into deflation. But the BoJ may find itself quickly in a situation in which a strong JPY does pose a serious problem for its inflation outlook. The BoJ has no realistic option other than deepening the negative rate if dramatic yen appreciation threatens to pull the plug.

"The sneaking doubt here is that perhaps we're witnessing the end of the great monetary easing experiment and that's obviously a very dangerous path for the BOJ. The pressure will only grow for the BOJ to do more." says Frederic Neumann, HSBC's co-head Of Asian economic research in Hong Kong.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand