Last minutes of Poland's MPC meeting suggest that economic growth should be same as projected for the month of July for the coming quarters. The council says the risks of economic growth drifted downside because of the recent developments abroad.

MPC council members opined "a risk of more expansionary fiscal policy in the coming quarters that could result from the implementation of the draft budget law for 2016 as well as the election promises."

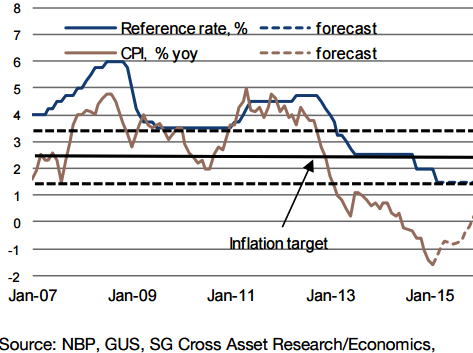

"Poland's MPC is likely to keep the key interest rate at 1.5% at its upcoming meeting and leave rates unchanged this year. Meanwhile, the updated inflation report is unlikely to indicate any change to current monetary policy", says Societe Generale.

The possible changes to monetary policy after the MPC staff changes next year are being focussed on by the investors.The official macroeconomic projections are to be released together with the updated inflation report after Wednesday's MPC decision.

The majority of council members would prefer to keep rates stable at the current level. However, certain members expressed an opinion that the council should consider the possibility of reducing interest rates in the coming months. In their opinion, this would support domestic demand and reduce the interest rate differentials between Poland and the euro area.

"The NBP's updated inflation report will contain minor changes to the CPI and GDP projections, which will be neutral for the market. We note that this will constitute the last report of the current council", opines Societe Generale.

The council members opine that inflation should gradually increase over the coming months, but at a slower pace than indicated by the July projection. In general they agree that starting from Q1 2016, the rise in inflation could come to a halt, and following that, inflation could remain slightly below the lower band for deviations from the target.

Poland's NBP likely to stay on hold

Wednesday, November 4, 2015 5:28 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022