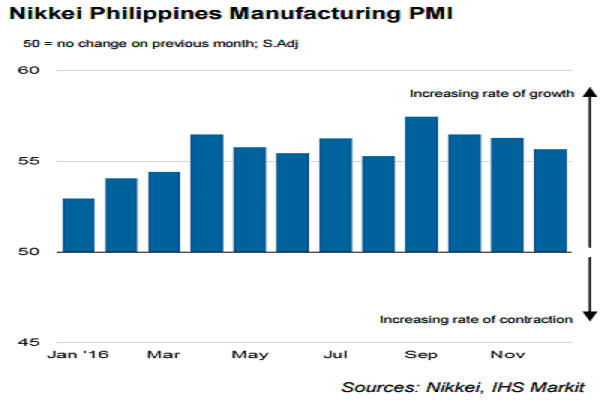

The growth of manufacturing in Philippines eased during the month of December, following a slower rise in new orders and as vendor performance deteriorated for the first time in survey history. Also, input cost inflation reached to survey high, accompanied by output price hikes.

At 55.7 in December, compared to 56.3 in November, the headline Nikkei Philippines Manufacturing Purchasing Managers Index (PMI) signalled another solid expansion in the Filipino manufacturing industry.

However, the headline index slowed for a third time in a row, where the latest reading was barely above the series average. While the increase in production volumes accelerated in the month, the rate of growth in total new sales decelerated for the third straight month.

Higher output was led by greater new orders placed at Philippines manufacturing firms, which reflected strong client appetite. However, the rate of expansion in new work was the slowest since March. Client demand from foreign markets continued to strengthen at the end of the year but at a slower pace after expanding at a record high rate in November.

Meanwhile, average lead times lengthened for the first time in the series history during December, though the rate of deterioration was moderate overall. Firms cited port congestions and custom bottlenecks as factors. Input cost inflation accelerated to the sharpest on record but the rate of increase in charged prices was broadly stable.

"On the prices front, Philippines manufacturing companies faced the sharpest rise in cost inflation in December as a combination of peso weakness and higher costs for raw materials lifted input prices. At the same time, hikes in selling prices were at broadly similar pace to recent months. If this continues, manufacturers’ profit margins may come under pressure in the coming months," said Bernard Aw, Economist, IHS, Markit.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination