Actual: 1.2% / 2.0% y/y (-0.1% / -0.1% m/m sa) Consensus forecast: 1.9%

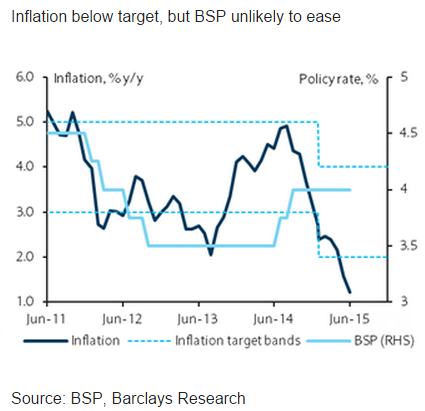

June inflation came in much weaker than expected. There were unexpected declines in clothing prices and housing rentals, which pushed core inflation down to a 22-month low of 2.0%. Rice inflation also softened further, against the expectations for a modest pickup. Despite the weakness, the print was nonetheless within BSP's guidance range of 1.1-2.0% for June.

BSP comfortable with policy stance for now. In comments after the release, BSP Governor Tetangco reiterated his concern over risks from El Niño (and added Greece) and said BSP would "monitor if there is a need to adjust policy", similar to comments after last month's inflation print. A prolonged period of below-target inflation could raise risks of a one-off cut, though the BSP appears comfortable with its stance for now.

El Niño risks remain. While near-term inflationary pressures have eased significantly, there are signs that drier-than-normal weather conditions are affecting agricultural output, with rice planting in some areas seeing delays. Given the risk of El Niño to food prices this year, and with growth likely to recover strongly from Q2, it is unlikely BSP will join other central banks in easing monetary policy.

"We forecast the next policy move will be a hike, most likely in Q4 15, after the Fed begins tightening",said Barclays in a report on Tuesday.

Philippines inflation falls further, but BSP still comfortable

Tuesday, July 7, 2015 2:33 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022