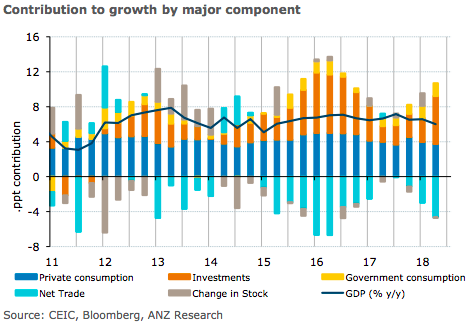

Philippines’ gross domestic product (GDP) for the second quarter of this year, failed to meet market expectations, coming in at 6.0 percent y/y and 1.3 percent q/q on a seasonally adjusted basis, compared to consensus estimates of 6.7 percent y/y. Net exports remained a drag on the overall performance, although domestic demand remained solid with its contribution to headline growth the highest in seven quarters.

At the component level, a 21.2 percent y/y growth in fixed capital formation underpinned the expansion in domestic demand. Private and government consumption grew at a slightly milder pace than that in the first quarter but still recorded solid growth of 5.7 percent y/y and 11.9 percent y/y, respectively. Inventories declined and were a modest drag on overall growth, ANZ Research reported.

Primarily owing to strong import growth of 19.7 percent y/y, the contribution of net exports to overall growth plummeted to -4.7 percentage points. This drag from net exports was the highest since Q2 2016.

"Based on realised H1 growth of 6.3 percent y/y, we are revising our full year 2018 GDP estimate to 6.6 percent from 6.8 percent previously. This downward revision notwithstanding, we remain of the view that domestic demand conditions remain strong and are the principal cause for the deterioration in the trade balance and accelerating inflation," the report commented.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX