The People’s Bank of China (PBoC) faces daunting challenges, including balancing growth, minimizing currency volatility, promoting economic stability, preventing asset price bubbles, ensuring adequate market liquidity and deleveraging the financial system. In order to overcome the limitations of traditional monetary policy and help it more effectively and efficiently control financial markets, the PBoC has recently introduced a wide range of quasi-monetary policy tools to ensure adequate market liquidity and reduce volatility.

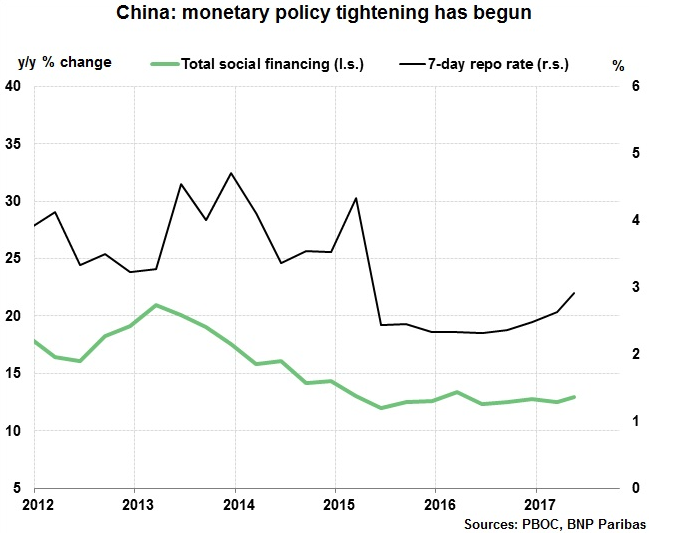

In addition, by altering the interest rates and funding tenors for different tools, the PBoC can strongly influence the cost of liquidity and investor behavior. The PBoC is using new regulatory powers to influence the demand and supply of market liquidity. China’s central bank has started to tighten monetary conditions since Q4 2016, principally via the rise in repo rates and the increase in the rates on its “liquidity facilities”.

Growth in financing of non-bank financial institutions has slowed rapidly as a result, suggesting that recent policy actions have had some impact on the interbank market. On the domestic bond market rates have soared and bond issuance has stopped rising, interrupting several years of steady expansion.

Growth in bank loans decelerated slightly in Q1 2017 but reaccelerated in April and May (standing at 12.8 percent year-on-year in May) while the lower bond financing has been partly compensated for faster growth in trust loans. Also, growth in total credit, measured by “social financing” has not slowed.

"We expect that total domestic debt growth will slow moderately in the short term, assuming that prudent monetary policy tightening will continue and that the authorities make further progress in strengthening regulation in the financial sector," said BNP Paribas in a report to clients.

A central bank survey released on Tuesday showed business confidence among China's entrepreneurs continued to improve in Q2, rising to 65.4 from 61.5 in the previous quarter, up for the fifth straight quarter. Another PBOC survey showed bankers' confidence in the economy also improved in the second quarter to 67.8 from 64.9 in the first quarter. The survey came as China's banking system was faced a mid-year liquidity strain due to seasonal factors including quarter-end regulatory reviews and tax payments, as well as tightening financial supervision.

The PBoC today set yuan mid-point at 6.8193/ dlr vs last close 6.8295. USD/CNY is currently trading around 6.8241 level after making an intraday high of 6.8342 and low of 6.8229. A sustained close above 6.8291 marks will test key resistances at 6.8526. Alternatively, a daily close below 6.8291 will drag the pair down towards key support at 6.8174.

FxWirePro's Hourly USD Spot Index was at 30.3329 (Neutral), while Hourly CNY Spot Index was at 27.5149 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness