The PBoC also set today's USD/CNY fixing lower than yesterday's fixing for the third consecutive day. The combination of new rules and a lower fixing is seen as a signal that Beijing is not likely to let its currency weaken in the near term unless the economy continues to disappoint.

Instead, the mid-August devaluations are seen as an attempt to convince the IMF to get the renminbi included in the IMF's SDR basket. In order for that to happen, the IMF wants Beijing to allow more exchange rate flexibility and a bigger role for market forces in setting the fixing.

It could seem that Beijing with one hand did change its currency regime on the 11 August to allow more market influence, but with the other hand increased its control on the markets by intervening heavily and coming up with new rules to limit speculation in a weaker CNY in forward markets.

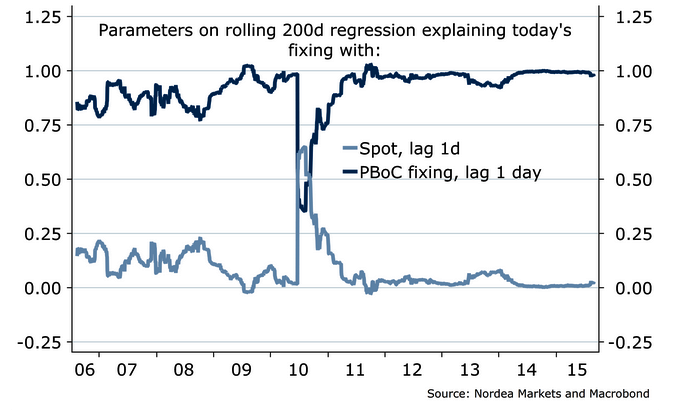

"The chart basically shows a 200-day rolling estimate of today's fixing using yesterday's fixing and yesterday's spot. If the markets are getting more influence on today's fixing, the parameter on yesterday's spot should gradually move away from zero while the parameter on yesterday's fixing should gradually move away from 1. So far there is little evidence that markets play a more significant role in setting the fixing, though. Well, markets may play a more significant role, but then the PBoC has just taken bigger control of the market forces", says Nordea Bank.

PBoC just taken bigger control of the market forces

Wednesday, September 2, 2015 7:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022