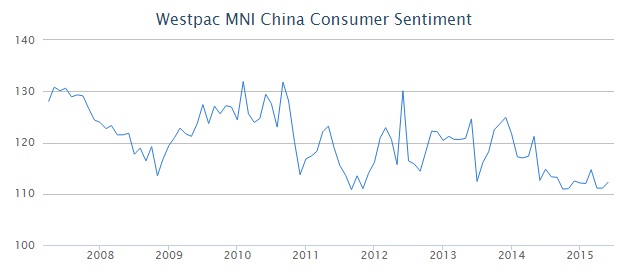

Actions from Peoples bank of China (PBOC) and rising stock market has helped Chinese consumers to regain some of their confidence, however recovery remains far off if pre-crisis (2008/09) or peak (2013) is considered.

- This week HSBC flash manufacturing PMI pointed at recovery but overall growth remain in contractionary zone. HSBC flash manufacturing PMI for June came at 49.6, better than prior 49.2, however still below 50 mark, above which expansion is called.

- Similarly, in housing sector, prices are going up rapidly, in tier 1 cities price growth surpassed previous peak, however this rapid growth is not coming in line with price growth inlands, which suggests current bounce back may not the recovery China is in search for.

Westpac MNI China consumer sentiment data was released today.

- China consumer sentiment rose by 1.1% to 112.3, after holding steady for two months. However the sentiment remains far from its pre-crisis high around 130. As of now it remains subdued with 1 year average at 112.4.

- According to MNI, today's sentiment was majorly improved by better outlook from aged people.

Further evidences are required before a recovery can be called over Chinese economy.

Chinese benchmark stock index is currently trading at 4634, up 1.8% for today.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?