The British vote to leave the EU has rattled markets across the globe, dampening the already weak global growth outlook. Initial extreme moves during the UK trading session were pared back with a chorus of central bankers offering up liquidity to the market, but volatility is unlikely to fade yet. The biggest concern is the destabilising effect an exit could have on the European continent as a whole. If other member states follow suit, the EU itself could slowly crack.

The International Monetary Fund has said in a report recently that the Brexit could knock up to half a percentage point off the combined output of all advanced economies by 2019, including the US and has warned that it may throw Britain, a key US trading partner, into sharp recession. The most obvious risk involves a drop in exports to the United Kingdom. That said, trade between the two nations only makes up 0.5% of U.S. economic activity, so even a sharp decline would be less than catastrophic and the US should be able to absorb this shock.

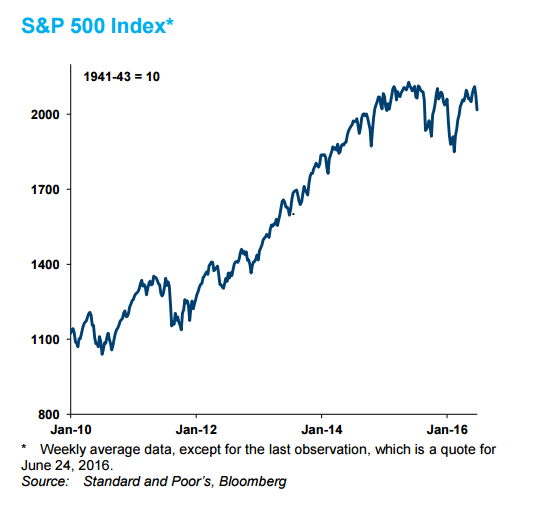

Domestic demand also could weaken in response to the Brexit vote. The drop in equity values will weaken the financial positions of many households, which could dampen consumer spending. In addition, the uncertain global economic outlook, along with a higher cost of capital because of the drop in share prices, could slow already weak investment spending.

Yellen forewarned earlier this week that Brexit "would negatively affect financial conditions and the U.S. economy." Speculation is on the rise about a possible interest rate cut by the Federal Reserve this year. As of now, the CME data shows a 7% probability of a rate cut this year.

"While the economic impact on the US is likely to be more modest, a weaker trade performance, stronger dollar and tighter financial conditions are not going to be conducive to near-term tightening. A Fed hike is no firmly off the table for July, and perhaps unlikely for September, after which Presidential election uncertainty might also weigh more heavily on investment," said Daiwa Capital Markets in a report.

Brexit also raises longer-term political risks that are clouding the picture. Scotland could reignite its independence efforts to be part of Europe. Less certain but quite possibly all or part of Northern Ireland will join Ireland. Brexit might be only the first step in a restructuring of the political landscape, and economic challenges will become greater if the independent movement spreads. The European Union is one of the world's largest trading blocs and it's a major trade partner with the United States. If it breaks, it could lead to a lot of global uncertainty and many trade deals would need to be restructured.

The market has stabilised after last week’s routing. GBP/USD hovers around 1.3320, while USD/JPY was around 102.02 as of 0920 GMT. S&P 500 Index was down 0.05% at 2020.4.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations