Onshore institutional demand is expected to support Malaysia’s 20-year bond auction worth MYR2 billion, scheduled to be held on October 28; however, 10-year yields are likely to rise, mainly tracking strength in U.S. Treasuries (UST). The size of the auction is in line with market expectations.

The domestic environment has improved slightly, but external headwinds remain. On the domestic front, the government’s deficit target of 3 percent of the gross domestic product (GDP) for 2017 has been well received by the market. Externally, the market continues to price in a December rate hike by the United States Federal Reserve, underpinning UST yields.

The last MGS auction was for the 5-year bond in September, with a modest bid/cover of 1.67x. Since then, the three GII auctions have seen decent demand with bid/cover of slightly over 2x. Along the curve, the 20Y bond is on the cheap side compared to 10Y and 30Y bonds. The last time it was this attractive was in February 2016, ANZ reported.

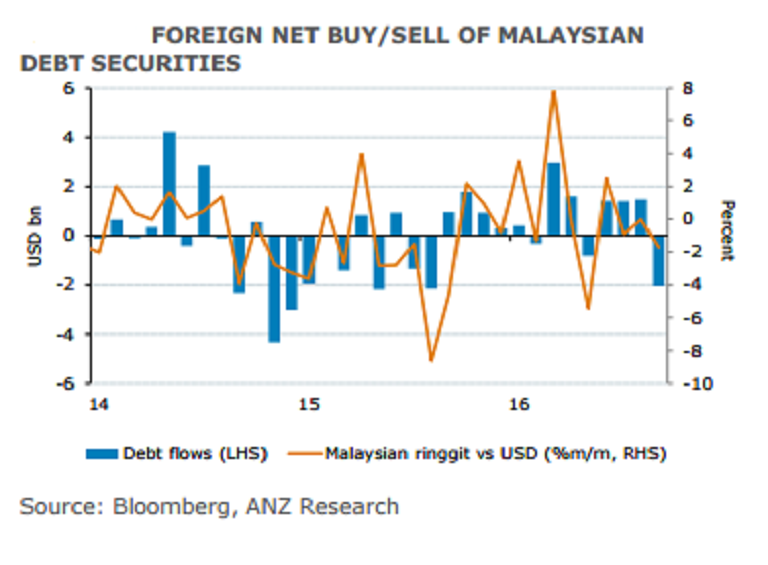

Meanwhile, foreigners turned into a net seller of USD2 billion of Malaysian debt securities in September after strong net buying of USD4.3 billion in the previous three months. Anecdotal evidence suggests that net selling has extended into October.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market