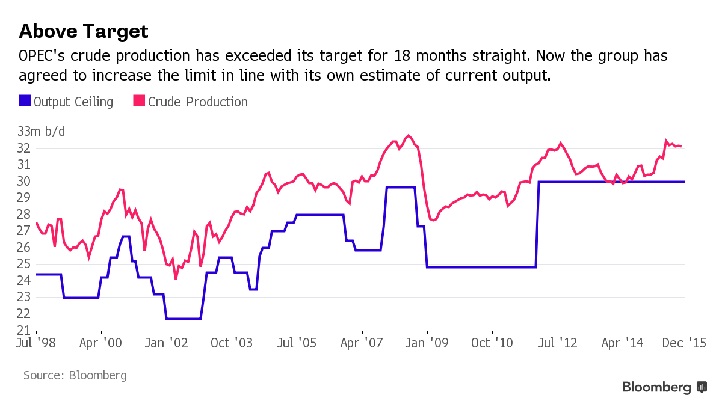

Two of the global benchmarks, WTI and Brent, are only few Dollars shy from lowest price of 2008/09 crisis, as OPEC last Friday not only failed to cut back production, they just dropped the ceiling. Nevertheless there seems to be some internal talk over the number 31.5 million barrels/day, which failed to appear in official commentary.

OPEC met in Vienna, there were some enthusiasm in the market that there could be some consensus and production cut, instead the meeting turned out to be so grim, that only few of the oil ministers commented afterwards. It was probably the worst OPEC meeting since 2011, when Saudi Arabian powerful oil minister had said to have his worst personal meeting. This time he left without any comments.

The few of those commented, they didn't seem very encouraged.

Iranian oil minister said "We have no decision, no number". On the ceiling he said, "Effectively its ceiling less. Everyone does whatever they want" OPEC's secretary general Abdullah al-Badri and Nigerian oil minister said they couldn't agree over any number as scenario regarding Iran is unclear. Iraq's oil minister pointed out that no one is happy after today's decision as oil price is low. He went as far as saying - "Americans don't have any ceiling. Russians don't have any ceiling. Why should OPEC have a ceiling?"

Rift was probably so apart that both Iran and Saudi ministers left Vienna immediately.

Next OPEC meeting is scheduled on June, next year. Despite, Mr. Badri's assurance of Cartel's strength, which was laughed at by analysts and reporters, not much is expected from OPEC hereon.

What is means for the market as OPEC goes ceiling less?

Immediate reaction is negative for oil market. Oil dropped immediately and continuing it on Monday.

However, it is important to note, that even without ceiling and with all members working for themselves, crude supply from OPEC will neither start rising on immediate basis nor exponentially. Only major supply increase are likely to come from Iran, of around 500-700 thousands of barrels per day.

Nevertheless, as the figure from Bloomberg shows, while OPEC has been breaching the ceiling for more than two decades, except for few months last year. Production has remained very much linked to the ceiling. So next few quarterly production figure will be vital to see if a de-facto ceiling remains (excluding Iranian crude.

It seems with no consensus in OPEC, sentiment for oil has soured further, which could mean lower for longer for the liquid gold.

Brent is currently trading at $42.9/barrel at $3.3/barrel premium to WTI.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX