If anyone is hurt the most in energy segment, it's the drillers.

Analogy is quite simpler, which hard evidence proves.

Fact check

- Oil price has fallen around 70%, since mid-2014. Then price was hovering above $100/barrel and now it is struggling in $30's.

- Baker Hugh US oil rig count, which is an indicator of number of wells actively producing crude oil has fallen by 72% from its 2014 peak, from 1600 to 439 as of last week's data. Next set will be released today.

- Despite drop in number of active wells in US, production has increased throughout first half of the year and started declining marginally, only in the second half. Production is still at levels of last year.

- According to IEA estimate, there is still 2 million barrels/day of excess crude in the world.

- Crude oil stock in OECD countries, at record high, more than 3 billion barrels.

- Demand to increase by 1.2 million barrels/day in 2016, lower than 1.6 million barrels/day observed in 2015.

Analogy

- If companies have to cut cost, they would surely look to curtail future investments. Even if they invest in oil fields, they would be very reluctant to develop them now.

- In a scenario, where oil price recovers, producers will be maintaining output and try to benefit from price rise.

- Only after significant demand increase and price rise, producers will start reactivating the idled wells.

- Only at the final stage, when oil outlook becomes very bright over next couple of years, investments would pick up in drilling sections.

This means many a dealer is doomed to fail.

Evidence

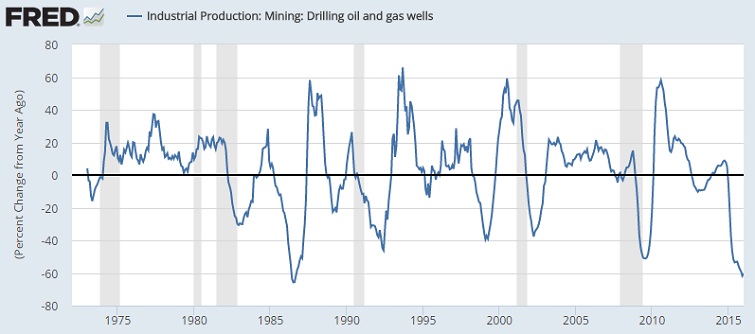

- The above chart should be enough supporting the theory of doom days. Industrial production index in drilling oil and gas well has fallen by more than 60% in December, just shy of its worst slump in 1986.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX