One of the many reasons, why oil price is struggling to recover is continued fight for market share among the top producers namely Saudi Arabia, Iran, Iraq and Russia. US can also be considered to have joined the fight with its lift of export ban and its shipments reaching shores of Europe. However unlike others, US is still net importer of oil. Several measures, such as relative supply to demand, global inventories are at levels not seen in decades and to add to that levels of competition currently being seen, hasn't been seen at least in three decades.

While Saudi and several Middle East players and even players from Africa are trying to bite into Europe, traditional playground of Russia, biggest Prize to grab for producers, however isn't Europe but Asia.

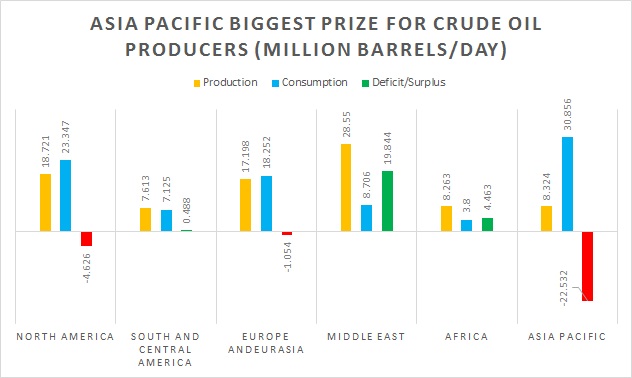

- According to latest data available from British Petroleum, Asia has largest daily oil deficit in tune of 22 million barrels/day, which is equivalent to combined total production of Saudi Arabia and Russia.

- That number is 5 times the total deficit of North America and 20 times more than the deficit in Europe (including Eurasia), still 2.5 times more excluding Russia from Eurasia.

- Moreover all will agree, over the next one or two decades, biggest increase in demand for Crude will come from China and India, while the developed nations slowly shift away from carbon intensive energy source.

As Saudi Arabia focuses on traditional Russian playground, Europe, expect Russia to form bilateral deals with Asian customers. Russia's close relation with China, could be advantageous for the former.

It is quite vital to watch out the on goings of current oil war, which could decide the future of global politics.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed