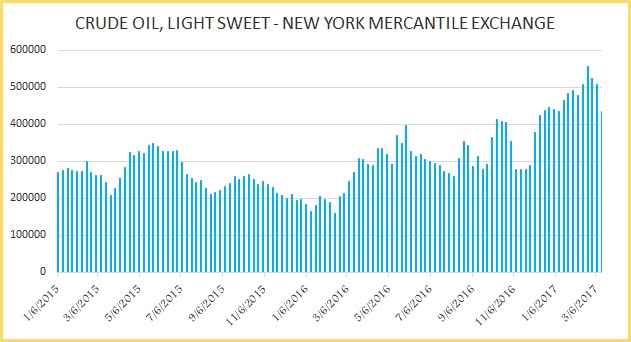

One of the biggest short-term risks for the oil price is the speculative long positions, which has been built by money managers, speculators and hedge funds in response to the OPEC and the non-OPEC deal last November, which would cut almost 1.8 million per barrel supply from the market if fully implemented. The commitment of traders report from the U.S. commodity futures trading commission (CFTC), show that on 21st February, speculative long positions in the North American oil benchmark WTI reached a record high of 556.6K contracts. But as the oil price failed to move higher largely due to intense hedging by producers and over the fear of increasing production from the United States, the speculators have started cutting back on their long positions. Over the past three weeks, speculative longs were cut by more than 122K contracts and the current speculative long position is the lowest since last December.

The oil price has also taken a big hit. Over the past three weeks, the price has declined by more than 10 percent and could go further down on continued long covering.

WTI is currently trading at $49.1 per barrel and the Brent at $2.8 per barrel premium.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed