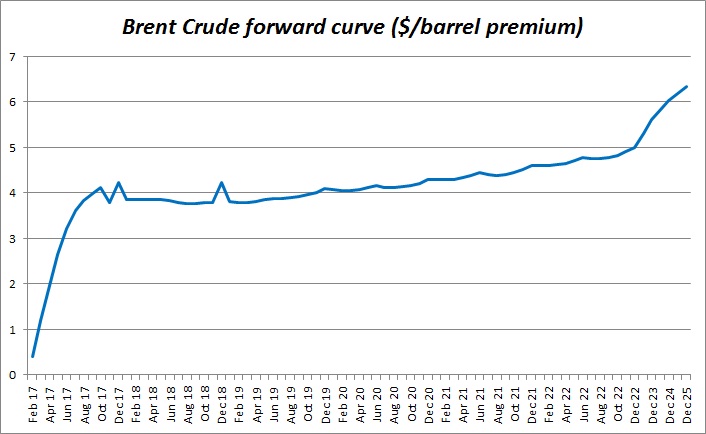

In a previous article, named, “Oil in Global Economy Series: Watch the contango and backwardation in oil market” dated 10th December and available at http://www.econotimes.com , we suggested to our readers that the backwardation in the market would tell them how effective the production cuts have been. The production cuts should create a squeeze in the spot market; thus pushing the oil curve to backwardation, a scenario, where spot prices are higher than that of those in the future or forward markets. Back then, the oil was still in contango and the cash was trading at 40 cents discount per barrel to future.

The chart shows the oil forward curve. The chart shows the forward curve from February this year to December 2025. The chart clearly tells us that as of now, there is no major squeeze in the market. The cash is still trading at a discount of 43 cents per barrel to the February contract. However, a sharp rise in the curve suggests that the market is expecting some squeeze in the near term but predicts the glut to be persistent in the longer run.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed