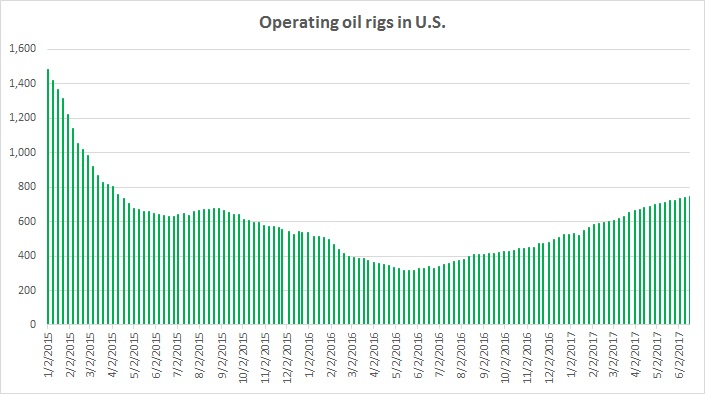

The U.S. oil producers have added rigs in their operations for 22 consecutive weeks, raising concerns that U.S. shale oil producers which were able to cut their production cost dramatically over the past years are now a low-cost global competitor and would continue to undermine the OPEC agreement to cut supplies. Last month, OPEC producers and 11 participating non-OPEC countries including Russia formally ratified the agreement first drafted last November to cut supplies by 1.76 million barrels per day. The new agreement extends the production deal for nine months until March 2018. However, the latest oil market report from OPEC showed that production increased by 336,000 barrels in May, thanks largely to two exempted countries, Libya and Nigeria.

Despite the agreement, the oil price suffered a major selloff on that day and was down around 3 percent by the end of the day. It is still continuing on its downward trajectory. Since the deal was ratified, the oil price (WTI) has declined 13 percent. The North American benchmark WTI is currently trading at $44.6 per barrel and Brent at $2.6 per barrel premium to WTI. The increased production in the U.S. and an increase in the numbers of operating rigs remain a big concern for the oil bulls.

The report from Baker Hughes shows that the numbers of operating rigs in the United States rose for the 22nd consecutive week. In the last week, there was an increase of 6 operating rigs in the US, pushing the total number to 747, the highest since April 2015. A separate report showed that U.S. oil producers are pumping at 9.33 million barrels per day, which is the highest level of production since August 2015. The production has increased by 902,000 barrels per day since bottoming around last July. EIA recently forecasted that production is set to rise by 920,000 barrels in 2017.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed