With the Japanese currency strengthening beyond 114 per dollar, the door remains open for BoJ to direct FX intervention. The rapid move in the Yen is fostered by international developments rather than a shift in domestic fundamentals. Intervention by the BOJ is likely to roil other nations that are already bearing the brunt of China's surprise currency devaluation last August.

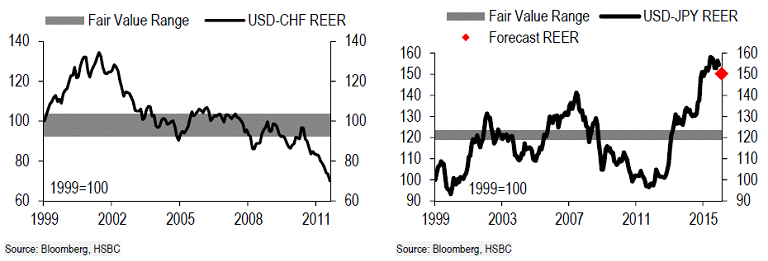

Is FX intervention by BoJ justified? The BoJ may argue FX intervention is justified in the same way that the SNB justified putting in a floor on EUR-CHF given the drivers of the current JPY surge. But the argument does not hold when we look at valuations. When the SNB implemented the EUR-CHF floor in late 2011, the CHF appeared to be significantly overvalued. On the other hand JPY is notably undervalued relative to the USD. This makes FX intervention harder to justify. Nevertheless, the fact that intervention may be harder to justify does not rule it out.

The success of Abenomics is dependent on JPY remaining undervalued and hence tolerance for even a return to fair value is extremely low. This raises the chances that authorities could intervene even though the currency is undervalued. But intervention to weaken an already undervalued currency has less likely chances for success and may as well undermine the policy's potency. Historical data is evidence to show that intervention by many central banks to reduce volatility has only resulted in slowing trend of appreciation, rather than a significant reversal, or even stabilisation, in the currency.

However, Japan's recent move to negative interest rates could be a possible differentiator. Post intervention (if any) the counterpart holding the JPY will either park it at the central bank at a cost of 10bp or buy JGBs. Now that the curve is negative up to 10 years this too will incur a cost. Hence a rush to sell the newly acquired Yen has the potential to further weaken it and therefore intervention could work.

A number of factors have to align to bolster the chances of successful FX intervention-the level of the currency, fundamental valuation, the broader policy backdrop and market positioning. There may be questions about the justification for direct intervention given the JPY is undervalued, or on intervention's likely chances of success, but if the Yen continues to strengthen rapidly, nothing will stop the BoJ from intervening.

USD/JPY had extended recovery to 114.87, but unable to hold above 114 handle and slips to currently trade at 113.82 at 1000 GMT.

Nothing will deter BoJ's intervention if Yen continues to strengthen rapidly

Tuesday, February 16, 2016 10:24 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings