Data keep on suggesting that China's slowdown if far from over. After Monday's earnings showed China's industrial profits contracted by -8.8%, today's PMI report suggests such contraction is likely to follow third quarter.

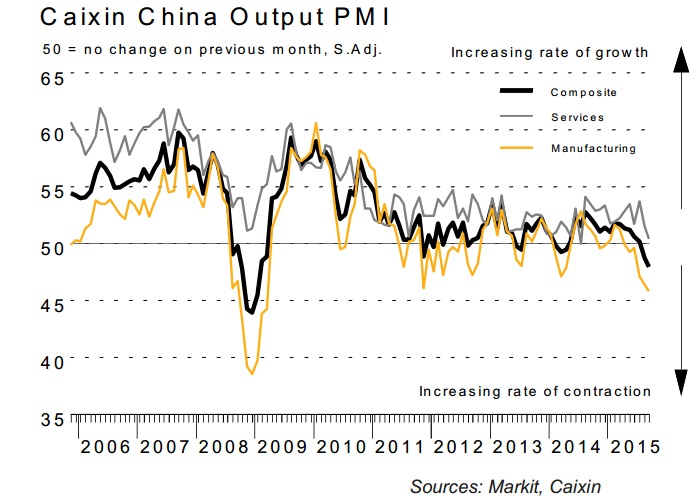

- China's composite PMI contracted for second consecutive month. Manufacturing PMI came at 47.2, better than flash reading of 47 but a value which is lowest in six and half years. China's services had held on well relatively well so far, but in September it just grew marginally as index dropped to 50.5, 14 month low.

- Moreover, composite PMI output index, which measures total business activity came at 48 in September, which signaled fastest rate of contraction since January 2009.

- Selling prices also pointing to further weakness. Both manufacturing and services sector reduced price due to weaker demand. Services sectors registered fastest reduction in selling prices in more than three years.

- However, China's services sector still added jobs to economy, while manufacturing sectors continued their payroll reduction at solid pace.

Volatility in broader financial markets, likely to persist as concerns regarding China is lingering. Any recovery in commodities should be taken with pinch of salt as they are likely to face headwinds.

Chinese markets are closed today over National day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?