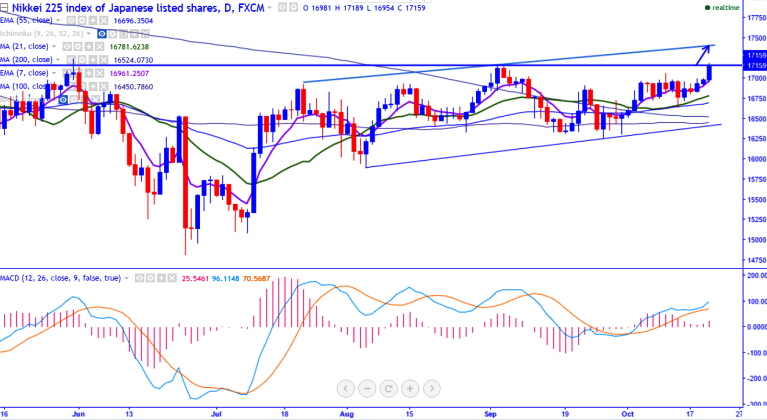

- Major resistance-170159 (Sep 2nd 2016 high).

- Nikkei225 breaks temporary top at 17159 and jumped till 17189 from that level.Japanese index is rising sharply for the past three trading session continuosly on account of weaker Yen.It is currently trading around 17159.

- Technically in the daily chart the index has slightly declined till 16954 and started to jump from that level. Minor weakness can be seen only below 16895 (7- day EMA).

- On the higher side, resistance is around 17000 and any break above targets 17159 (Sep 2nd 2016 high)/17322 (161.8% retracement of 17062 and 16641)/17420 (trend line joining 16930 and 17159)/17695.

- The major support is around 16895 (7- day EMA) and any break below targets 16755 (21- day MA)/16640.

It is good to buy on dips around 17100 with SL 16985 for the TP of 17322/17695.