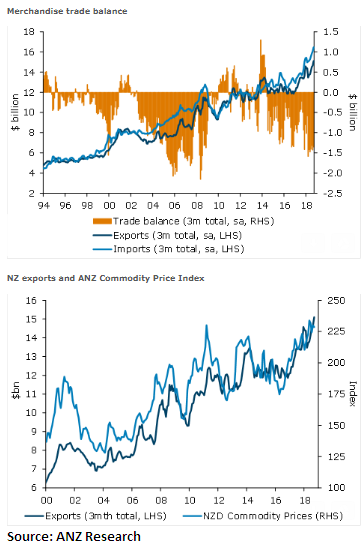

New Zealand’s unadjusted monthly trade deficit widened by USDD90 million in September to USD1,560 million, worse than market expectations. Both exports and imports surprised on the upside, with large items (aircraft) adding USD275 million to the import side and accounting for much of the surprise.

On a seasonally adjusted basis, exports rose 9.2 percent m/m, with dairy up 9.7 percent m/m on higher volumes and prices (the weaker NZD is clearly doing its job here, but there are downside risk in the global market). The real winner was fruit, with values and volumes up 47.6 percent and 34.1 percent m/m respectively.

Seasonally adjusted imports lifted a solid 11.6 percent m/m. However, the 6.4 percent fall in mechanical machinery and equipment is a tentative sign that investors are cautious at present. But these data are volatile. A rebound in petrol also boosted. Overall, imports ex-large items came in largely as expected: more or less in a holding pattern. While large items should boost business investment, the underlying picture is hardly one to get excited about.

On a quarterly basis, the seasonally adjusted goods deficit narrowed USD300 million to USD1.1 billion – not enough to prevent a widening annual goods deficit in the upcoming Q3 Balance of Payments. However, quarterly export volumes are holding up, which should at least keep pace with imports growth in Q3.

Despite recent slippage in world prices for some of our key exports, the annual deficit is expected to narrow over the year ahead, reflecting solid dairy volumes and NZD weakness. As always, however, much depends on the global situation, particularly China. And it’s fair to say things are looking a little more wobbly on that front.

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations