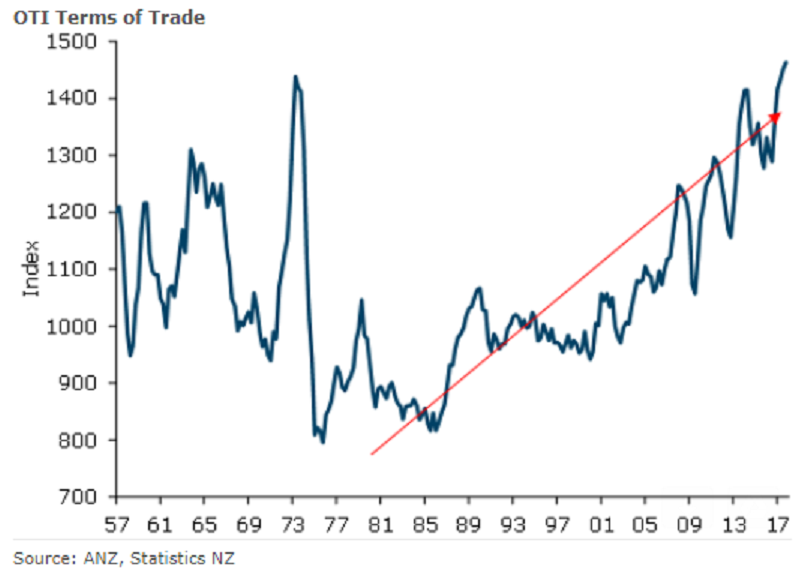

New Zealand’s terms of trade hit a new all-time higher in the last quarter of 2017, as broad-based export commodity price strength continued to support. Import volumes surged over the quarter, at face value suggesting a large drag on Q4 GDP growth.

However, some of this will need to be discounted as it will reflect leased Air NZ planes that won’t be included in the GDP figures. Nevertheless, net exports do still look like they will drag on the Q4 GDP accounts overall.

The OTI goods terms of trade rose 0.8 percent q/q in Q4, to a new all-time high. It follows an upwardly revised 1.3 percent q/q gain in Q3 (previously reported at 0.7 percent). It is clearly a positive story in terms of what it implies for national incomes and the economy’s overall purchasing power and reflects both cyclical and structural forces.

NZD import prices rose 4.0 percent q/q, which implies a fall in prices in “world” terms of around 0.6 percent q/q. It occurred despite a large increase in petroleum and related product prices and reinforces that outside of commodity price moves, the global inflationary environment remains subdued.

Seasonally adjusted export volumes rose 2.6 percent q/q, supported by strong meat, seafood, and forestry exports. Import volumes surged 8.5 percent q/q, which is the strongest quarterly growth since 1999. Import demand is strong.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom