New Zealand’s migration data showed tentative signs of stabilising in Feb. But strong annual inflows seem a little out of whack with the recent slowdown in economic momentum. It appears there is still noise in these data, according to the latest report from ANZ Research.

Surprisingly, revisions to net migration data this month (a consequence of last year’s change to the outcomes-based collection methodology) didn’t change the face-value story from what last month’s data were showing. That is, the net migration cycle has turned a corner and annual inflows are trending higher.

"However, we remain sceptical. Economic momentum has slowed, and with population growth such a dominant driver of GDP growth this cycle it doesn’t make sense that the economy is slowing while the trajectory for net migration is shooting for 2016 cycle-highs," the report added.

But if this data is believed on face value, it suggests population growth accounts for more of the recent strength in private consumption growth and that rising real incomes have contributed less. And it’s not a good story from a labour productivity perspective.

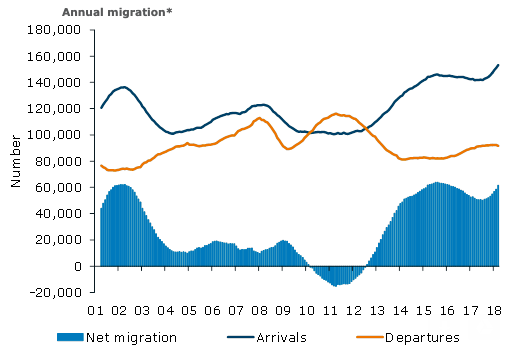

Turning to the details, annual net migration reportedly picked up to 61,600 in February, around 2,400 shy of its record-high in June 2016. On a three-month moving sum basis, net migration has lifted by 3,600 (sa) with departures down 1,450 and arrivals up 2,150.

In part, this lift in net migrants may turn out to be a misallocation of total people as migrants rather than short-term visitors. While short-term arrivals of overseas visitors remain at a high level (3.87m visitors over the past year), they have fallen for the third consecutive month to be down 12,000 on a three-month sum basis. Monthly arrivals for February are 16,000 less than seen in November 2018.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022