New Zealand’s economic growth is expected to slow down over the next few quarters before increased government spending starts to kick in and boosts GDP growth over 2019. Inflation is expected to hold near the 2 percent target midpoint this year, although some government policies, such as free tertiary education, might actually depress CPI inflation over this year, according to a recent report from Westpac Research.

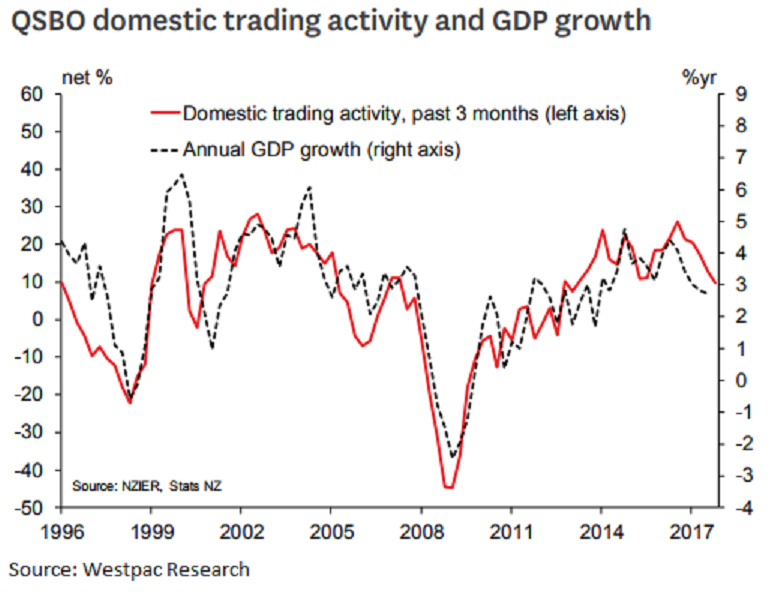

According to the country’s NZIER Quarterly Survey of Business Opinion (QSBO) showed a drop in business confidence in the December quarter, in the wake of the recently formed Labour-led Government. General business sentiment fell from +5 to -11, which was the first negative reading in more than two years. Firms’ own reported and expected trading activity saw more modest declines.

As the economy’s spare capacity has been used up over recent years, the price measures in the QSBO have moved off their lows. By and large, these measures are not suggesting a risk of a break higher in inflation; rather, the era of stubbornly low inflation in the wake of the global financial crisis appears to have passed.

"One of the reasons we downgraded our growth forecasts for 2018 is that we expect a temporary hiatus in business investment, as firms get to grips with the new government’s policies. The QSBO provides some support for that view: firms’ intentions to invest in plant and machinery fell from 17 to 12, the lowest in two years," the report said.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility