According to New Zealand’s NZIER quarterly survey of business firms, business confidence continued to fall during the third quarter of this year and firms’ domestic trading conditions continued to soften. Also, political uncertainty and margin-squeeze are weighing and capacity pressures eased slightly, which is consistent with growth running below trend of late, although finding skilled staff remains a clear challenge.

Headline business confidence fell from 17 to 7 – that is consistent with the signal from our own Business Outlook survey. Political uncertainty is no doubt weighing. But sentiment remained above long-run averages and interestingly the drop wasn't as sharp as in other pre-election periods (normally 19 point drop vs 10 points this time). Most regions saw a drop in confidence, but Northland experienced a lift, perhaps due to regional election campaign promises.

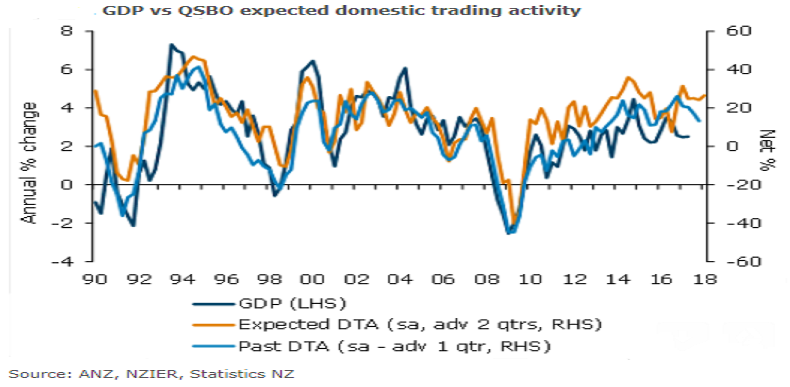

Firms’ experienced domestic trading conditions fell, from a net 17 percent to 13 percent. However, businesses remain optimistic about the outlook (with expectations rising from +24 to +27).

Overall, indicators are consistent with GDP growth around 3 percent, which is really about expectations pulling back towards reality – indicators had previously been suggestive of growth up towards 4 percent, which looked a stretched given late-cycle headwinds.

"The weaker sentiment from the construction and services sector is also consistent with our view that the economy is in a transition phase as some of its previous growth drivers (housing, construction, tourism, migration) peak, and we await others to step in and fill the void," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal