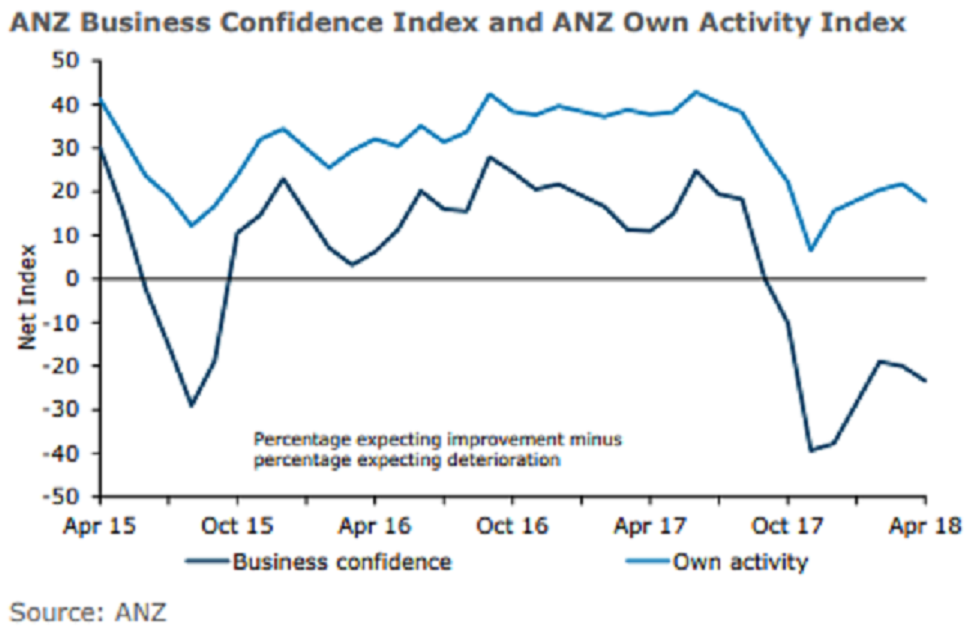

New Zealand’s ANZ business confidence index and firms’ views of their own activity dipped further in April and the construction sector fell sharply despite a perceived easing in credit availability. A net 23% of businesses are pessimistic about the year ahead, down 3 points from March.

All sectors are in the red, with services the least pessimistic and agriculture the most. Agriculture did manage a small gain in March, but construction plummeted to its lowest level since 2008. Firms’ views of their own activity (which has the stronger correlation with GDP growth), eased from 22 to 18.

Manufacturing and agriculture lifted; construction fell a startling 38 points – excluding this sector the aggregate eased only 1 point. The survey was a mixed bag this month, consistent with an economy pushing its way through capacity constraints and some residual policy uncertainty but with some solid support from record-high terms of trade.

A net 7 percent of firms are expecting to lift investment, reversing March’s lift. Employment intentions eased 1 point to 9 percent. Profit expectations reversed March’s lift, back from 6 to -1 percent. Export intentions remained solid at 23 percent, down 1 point. A net 26 percent of businesses expect it to be tougher to get credit, an improvement of 2 points.

Firms’ pricing intentions eased from 29 percent to 22 percent, with retail sector pricing intentions dropping 15 points to 6 percent, their lowest since 2004. Inflation expectations were again unchanged at 2.1 percent. Residential construction intentions dropped sharply from 33 percent to 9 percent. Commercial construction intentions eased from 9.5 percent to 5 percent.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out