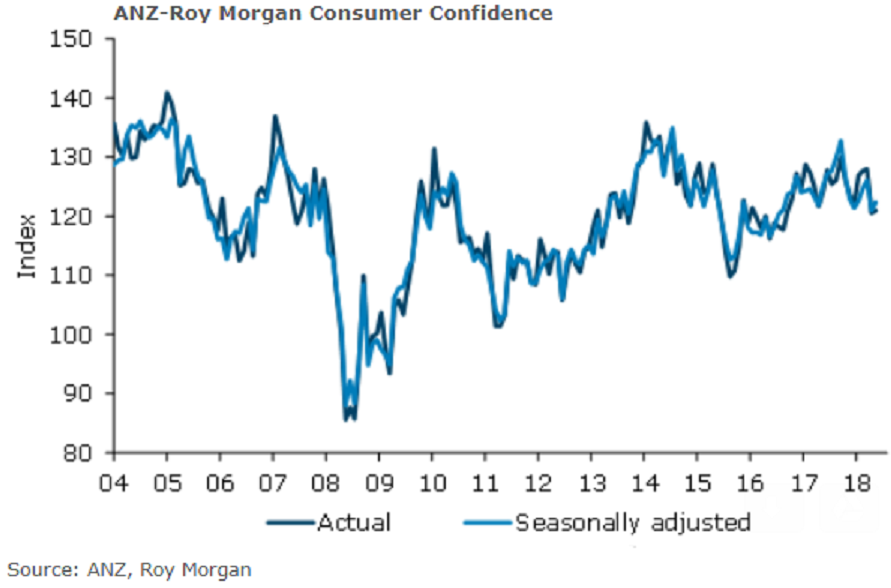

New Zealand’s ANZ-Roy Morgan consumer confidence Index remained steady at 121 in May. This is just above the average of the series since its inception in 2004. On a seasonally adjusted basis, the index rose 1 point to 122.

The Current Conditions Index rose 2 points to 124.6 in May, while the Future Conditions Index was broadly unchanged at 118.5. Both are trending more or less sideways. Consumers’ perceptions of their current financial situation bounced back 4 points to a net 13 percent feeling financially better off than a year ago.

A net 27 percent of consumers expect to be better off financially this time next year, up 2 points. A net 36 percent say it’s a good time to buy a major household item, down 1 point from April. This remains at a strong level and should support durables spending.

Perceptions regarding the next year’s economic outlook eased a further point to 12 percent, around its December low. The five-year outlook also dipped 1 point from 18 percent to 17 percent, the lowest since May 2017.

Confidence fell 5 points in Auckland – this is now the least confident region, with the rest of the North Island also relatively subdued. South Island confidence rebounded strongly, and Wellington confidence is high.

National house price expectations dipped from 4.1 percent to 3.7 percent and remain strongest amongst Wellingtonians (4.3 percent). Inflation expectations were all but unchanged at 3.9 percent.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX