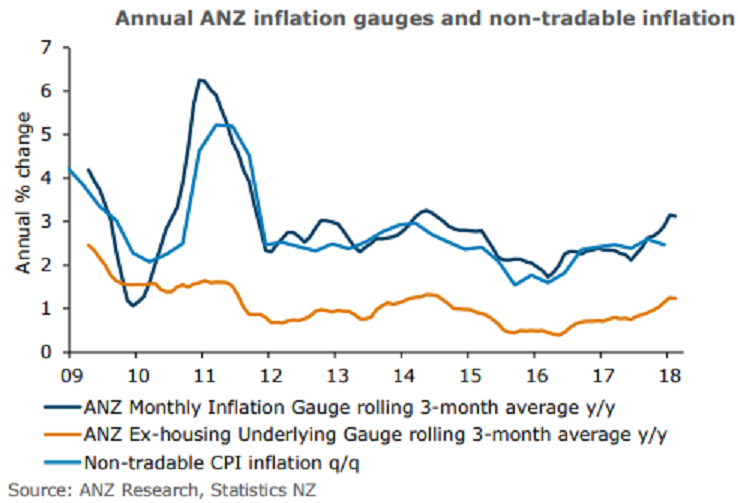

New Zealand’s ANZ Monthly Inflation Gauge fell 0.3 percent m/m in February to be 3.1 percent higher than a year ago. Changes to tertiary education costs as a result of the Tertiary education fees free policy are included in this month’s gauge.

The fall in tertiary education costs had the biggest impact of the subcomponents in the Gauge (-0.34 percentage point contribution). A third of the 36 subcomponents rose in the month, with the biggest contributors being rents and purchase of housing (+0.12 percentage point and +0.04 percentage point respectively).

Of the five subcomponents that fell, seasonal falls in domestic air transport (-0.09 percentage point) and accommodation (-0.06 percentage point) were the largest contributors, outside of education. Despite the Gauge recording decent upward momentum at present it does not suggest that a sustained lift in inflation is around the corner.

"We estimate tertiary education costs fell 18 percent. Without this, this subcomponent would have increased 2 percent m/m and the overall Gauge would have increased 0.1 percent m/m," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm